The recently enacted Public Financial Management Act, No. 44 of 2024 and the Parliamentary Budget Office Act, No. 6 of 2023 contain several key policy actions aimed at improving public finance management in Sri Lanka. Notably, four of these policy actions are similar to the recommendations proposed by Verité Research.

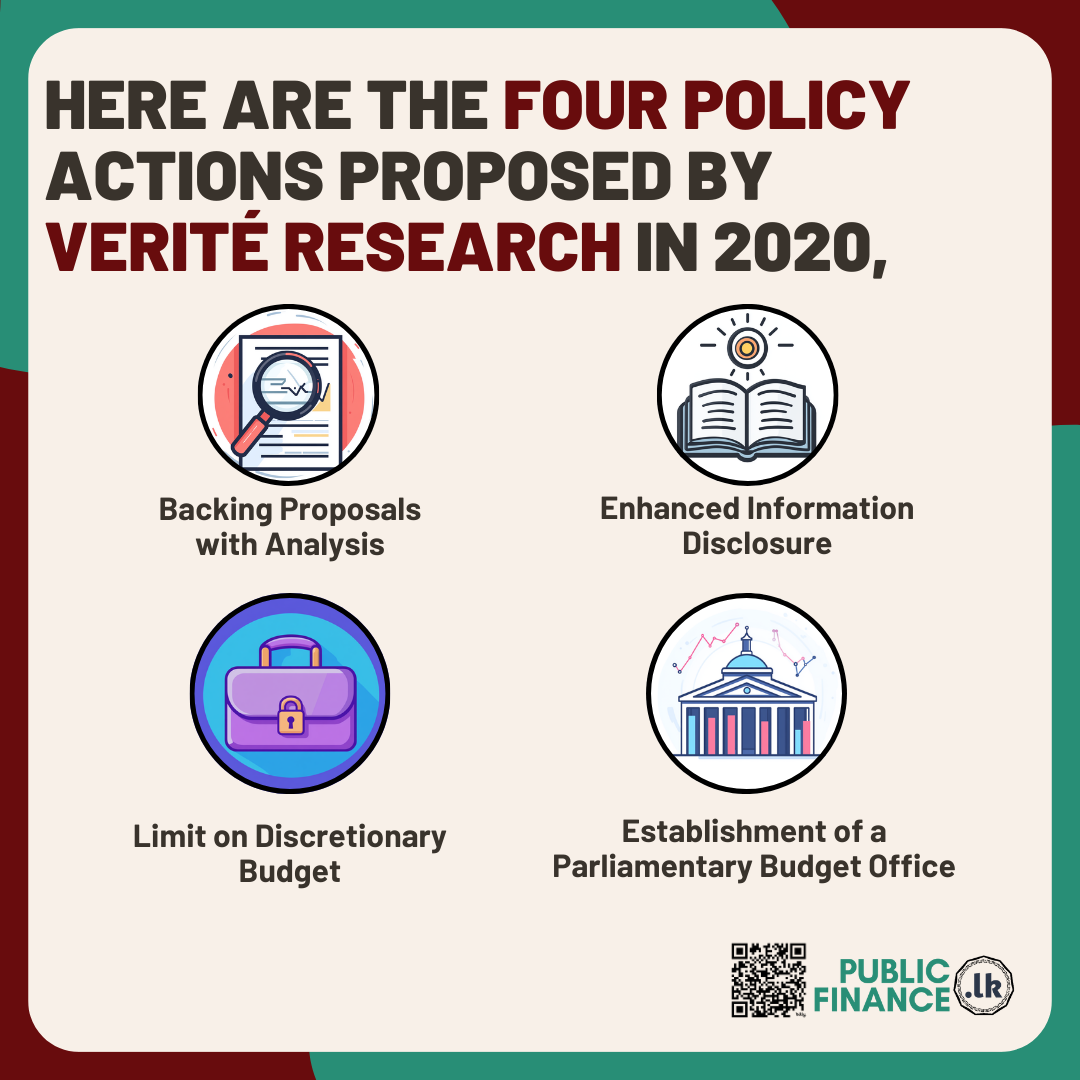

Verité Research proposed four policy actions in 2020

In February 2020, Verité Research organized a forum (Forum Presentation) with key stakeholders, including government officials, to address critical issues in Sri Lanka’s public finance management and propose essential reforms. During this forum, Verité Research highlighted key policy actions necessary to enhance the country's public finance processes: They include;

1. Backing Proposals and Estimates with Analysis

Verité Research emphasised the importance of supporting all revenue and expenditure proposals with comprehensive and detailed information. This includes:

2. Enhancing Information Disclosure

The forum stressed the need to increase transparency by improving the disclosure of financial information. Verité Research proposed that all disclosed information should be consistent, clear, and accessible. This includes:

3. Limiting the Discretionary Budget to 2% of Expenditure

Verité Research proposed a strict limit on the discretionary budget—expenditures allocated under the Development Activities budget head of the Department of the National Budget. These discretionary funds, which can be used by senior Ministry of Finance officials (Secretary to the Treasury, Deputy Secretary to the Treasury, or the Director General of the National Budget Department), should be capped at 2% of the government’s total expenditure.

This recommendation was made in response to past misuse of discretionary funds, where the flexibility intended for unforeseen expenditures was exploited for purposes such as purchasing motor vehicles for government ministers and officials—expenditures not initially anticipated in the budget.

4. Establishing a Parliamentary Budget Office

A Parliamentary Budget Office will provide technical, reliable, and non-partisan analysis of budgetary reports to the public, and support parliamentary Committees and members of Parliament. This office will contribute to continuous improvements in public finance reforms, enhance the credibility of budgets and fiscal policies through independent expert opinions, and strengthen Parliament's role in budget approval and oversight.

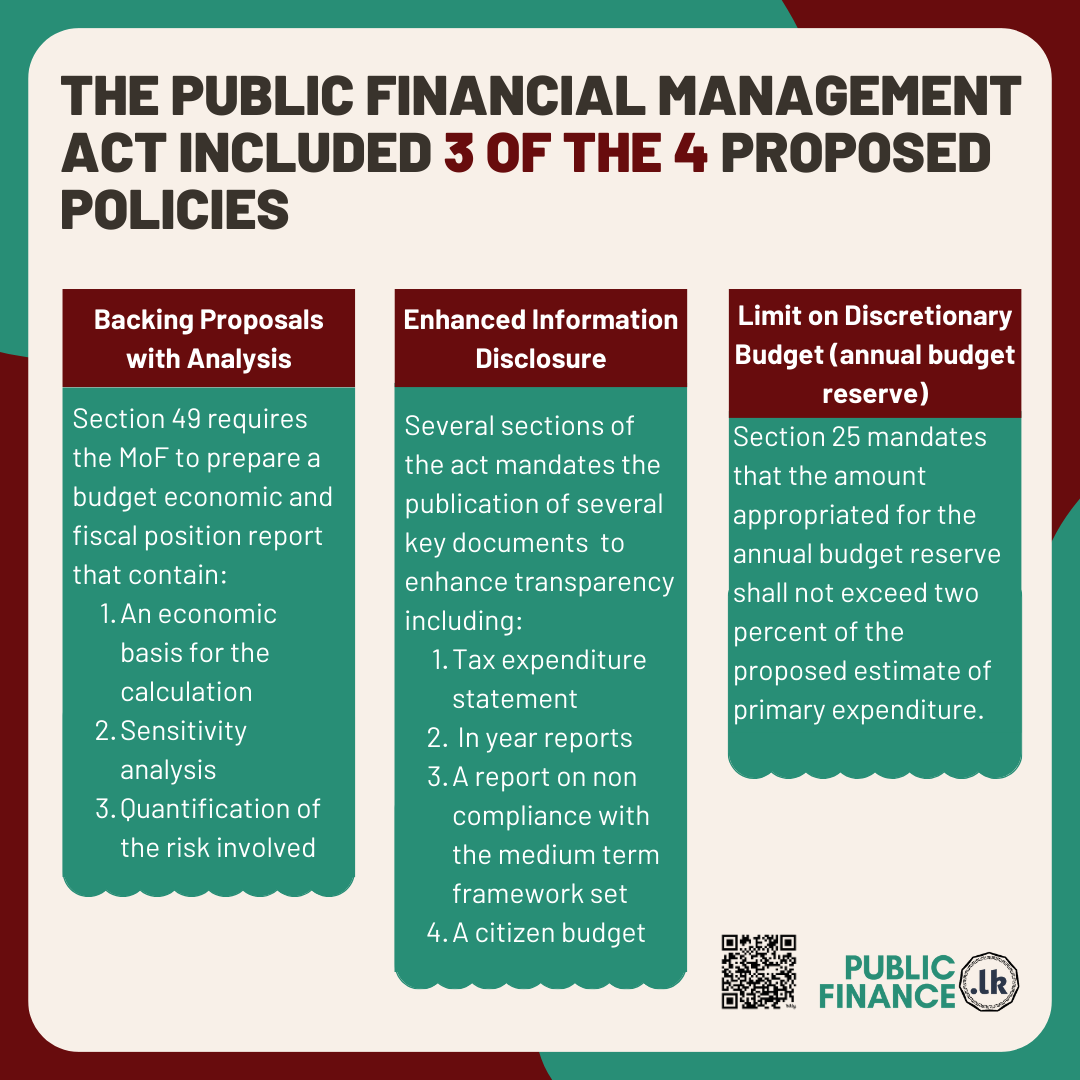

1. Backing Proposals and Estimates with Analysis

Section 49 of the Public Financial Management Act (PFM) mandates the government to publish information on the basis for the estimates, a sensitivity analysis, and a quantification of the risks to the fiscal position.

However, the PFM Act does not require a feasibility assessment of the proposals, which was another suggestion made by Verité Research. This recommendation is critical, as a feasibility assessment ensures that government funds are allocated to economically viable projects.

2. Enhancing Information Disclosure

The PFM Act requires the government to publish a wide range of information to improve transparency.

|

|

Disclosure Requirement |

Section |

|

Annual Reports |

Fiscal Strategy |

Section 11 |

|

Medium-Term Fiscal Framework |

Section 12 |

|

|

Annual Budget Document and Accompanying Documents including;

|

Section 20 |

|

|

Final Budget Position |

Section 51 |

|

|

Annual Government Financial Statements |

Section 53 |

|

|

Debt Sustainability Analysis |

Section 13 |

|

|

Annual Financial Statement |

Section 47 |

|

|

Annual Performance Report and Annual Reports of Public Entities (Public Entities includes (a)budgetary entities; b)Statutory Funds and Trusts to which public finances are allocated; c) State-Owned Enterprises; and d) Provincial Councils, Provincial Ministries, Provincial Departments, other Institutions functioning under the Provincial Councils, and Local Authorities in terms of the relevant written laws)

|

Section 47 |

|

|

In- year Reports |

Quarterly Financial Performance Statement |

Section 53 |

|

Mid-Year Fiscal Position Report |

Section 50 |

|

|

Special Reports |

Report on Non-Compliance with Primary Balance Target |

Section 14 |

|

Report on Guarantee Limit Breach |

Section 17 |

|

|

Transfer Reporting under Virement Procedure |

Section 24 |

|

|

Report on Annual Budget Reserve Allocation |

Section 25 |

|

|

Supplementary Estimate Proposal |

Section 26 |

|

|

Statement on Excess Expenditure |

Section 27 |

|

|

Pre-Election Budgetary Position Report |

Section 52 |

3. Limiting the Discretionary Budget

Section 25 of the PFM Act mandates that the annual budget reserve (discretionary budget) shall not exceed 2% of the proposed estimate of primary expenditure. Primary expenditure refers to the total expenditure of the Government, excluding debt servicing.

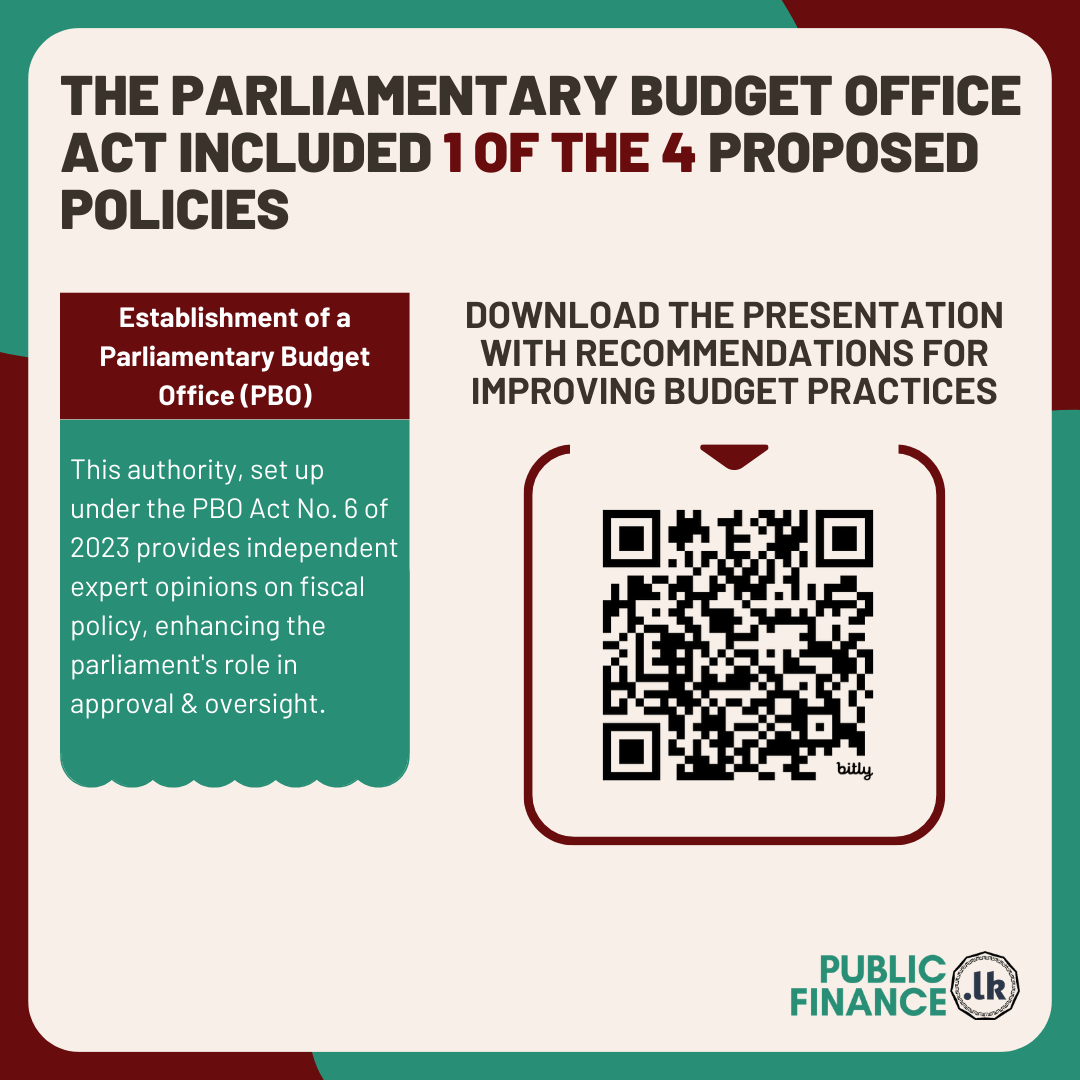

1. Establishing a Parliamentary Budget Office

The Parliamentary Budget Office Act, No. 6 of 2023 establishes an independent Parliamentary Budget Office (PBO) in Sri Lanka. The PBO is designed to assist Parliament in its public finance responsibilities by providing independent, non-partisan analysis related to the budget, fiscal policies, and economic forecasts. It also offers cost analysis for policy proposals and political party manifestos, especially during elections.

Note: Verité Research also proposed a fifth recommendation to extend the budget timelines to at least 5 to 7 months. This would ensure that there is sufficient time for the preparation of budget estimates and proposals, as well as thorough scrutiny of the budget in parliament. However, the government has not yet taken any action to implement this measure.

Sources:

http://www.documents.gov.lk/files/act/2024/8/44-2024_E.pdf