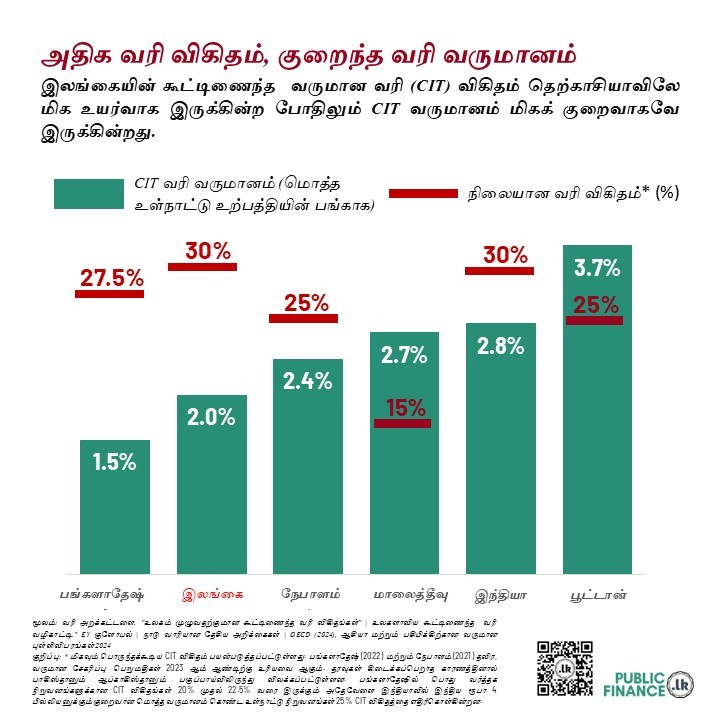

இலங்கையில் கூட்டிணைந்த வருமான வரி (CIT) விகிதம் அதிகமாக இருந்தாலும், ஏனைய தெற்காசிய நாடுகளை விட அதன் வருமானம் குறைவாகவே உள்ளது. 2023 ஆம் ஆண்டில் இலங்கையின் CIT வருமான சேகரிப்பு மொத்த உள்நாட்டு உற்பத்தியில் 2.0% ஆகவும், CIT விகிதம் 30% ஆகவும் இருந்தது. மாறாக, பூட்டான் மற்றும் மாலைத்தீவு போன்ற ஏனைய தெற்காசிய நாடுகள், குறைந்த CIT விகிதங்களான 25 மற்றும் 15 சதவீதங்களில் மொத்த உள்நாட்டு உற்பத்தியில் முறையே 3.7% மற்றும் 2.7% ஐயும் வருமானமாகச் சேகரித்துள்ளன. 30% CIT விகிதத்தைக் கொண்ட இந்தியா இலங்கையை விட அதிக வருமானத்தை ஈட்டுகின்றது. பங்களாதேஷ் மட்டுமே குறைவான CIT வருமானத்தை (2022 இல் மொத்த உள்நாட்டு உற்பத்தியில் 1.5%) சேகரிக்கின்றது. ஆனால் கூட்டிணைந்த வருமானத்திற்கு 27.5% எனும் குறைந்த விகிதத்திலேயே அந்நாடு வரி விதிக்கின்றது.

கடந்த காலங்களில் கூட, இலங்கை அதிக விகிதத்தைக் கொண்டிருந்தாலும் சேகரிக்கப்படும் வருமானம் குறைவாகவே இருந்தது. கடந்த தசாப்தத்தில் (2013 -2023) இலங்கையின் சராசரி CIT வருமானம் மொத்த உள்நாட்டு உற்பத்தியில் 1.5% ஆக இருந்ததுடன், இது தெற்காசிய சராசரியான 3.4% ஐ விட குறிப்பிடத்தக்க அளவு குறைவாகும். உதாரணமாக, பூட்டானில் 2021 ஆம் ஆண்டுக்கு முன்னர் 30% CIT விகிதத்துடன் (2021க்குப் பிறகு 25% ஆகக் குறைக்கப்பட்டது) மொத்த உள்நாட்டு உற்பத்தியில் 6-7% CIT வருமானம் தொடர்ச்சியாகச் சேகரிக்கப்பட்டது. கடந்த காலங்களில் பங்களாதேஷின் CIT சேகரிப்பு கூட இலங்கையை விட அதிகமாகவே உள்ளது. 2020 மற்றும் 2022க்கு இடைப்பட்ட காலப்பகுதியைத் தவிர, இலங்கையின் CIT விகிதம் தொடர்ந்து 28% அல்லது அதற்கு அதிகமாகவே இருந்துள்ளது. இந்த விகிதம் 2013-2023 ஆண்டுகளில் தெற்காசிய சராசரியான 26% ஐ விட அதிகமாக உள்ளது.

சில துறைகளுக்கான சலுகை வரி விகிதங்கள் மற்றும் ஏனையவற்றுக்கான வரி விலக்குகள் என்பன கடந்த காலங்களில் இலங்கையின் குறைந்த வருமானத்திற்குக் காரணமாக இருக்கலாம். உதாரணமாக, 2022 ஒக்டோபருக்கு முன்னதாக, சிறிய மற்றும் நடுத்தர நிறுவனங்கள், கல்விச் சேவைகள் மற்றும் சுகாதாரம் போன்ற துறைகள் 14% சலுகை விகிதத்தால் பயனடைந்த அதேநேரம், உற்பத்தி வணிகங்கள் 18% வரி விகிதத்தை எதிர்கொண்டன. எனினும் தொண்டு நிறுவனங்கள், அரச அமைப்புக்கள், குறிப்பிட்ட சர்வதேச நிறுவனங்கள் மற்றும் சில வகையான ஆதாயங்களுக்கு வரி விலக்குகள் தொடர்ந்து வழங்கப்படுகின்றன.

வரி சேகரிப்பு அமைப்பில் உள்ள திறமையின்மையும் குறிப்பிடத்தக்க பங்கு வகிக்கலாம். 2022 ஆம் ஆண்டின் 45 ஆம் இல. உண்ணாட்டரசிறை (திருத்தச்) சட்டம் இயற்றப்பட்டதன் மூலம் பெரும்பாலான சலுகைகள் அகற்றப்பட்டன. இது நிலையான CIT விகிதத்தை 24% இலிருந்து 30% ஆக உயர்த்தியது. இந்த சீர்திருத்தங்களுக்குப் பின்னரும், CIT வருமானம் 2022 இல் மொத்த உள்நாட்டு உற்பத்தியில் 1.93% இல் இருந்து 2023 இல் 2.03% ஆக உயர்ந்து, ஒரு சிறிய அதிகரிப்பை மட்டுமே காட்டியது. இது வரி அமைப்பில் உள்ள திறமையின்மையை எடுத்துக்காட்டுகின்றது.

குறிப்பு

நிலையான வரி விகிதம்: மிகவும் பொருந்தக்கூடிய CIT விகிதம் பயன்படுத்தப்பட்டுள்ளது.

பங்களாதேஷ் (2022) மற்றும் நேபாளம் (2021) தவிர, வருமான சேகரிப்பு பெறுமதிகள் 2023 ஆம் ஆண்டிற்கு உரியவை ஆகும்.

தரவுகள் கிடைக்கப்பெறாத காரணத்தினால் பாகிஸ்தானும் ஆப்காகிஸ்தானும் பகுப்பாய்விலிருந்து விலக்கப்பட்டுள்ளன.

பங்களாதேஷில் பொது வர்த்தக நிறுவனங்களுக்கான CIT விகிதங்கள் 20% முதல் 22.5% வரை இருக்கும். அதேவேளை இந்தியாவில் இந்திய மதிப்பில் ரூ.4 பில்லியனுக்கும் குறைவான மொத்த வருமானம் கொண்ட உள்நாட்டு நிறுவனங்கள் 25% CIT விகிதத்தை எதிர்கொள்கின்றன.

மூலங்கள்

வரி அறக்கட்டளை. "நாடுகளுக்கான கூட்டிணைந்த வரி விகிதங்கள்: 2023." வரி அறக்கட்டளை, 2023,

உலகளாவிய கூட்டிணைந்த வரி வழிகாட்டி." EY குளோபல் https://www.ey.com/en_gl/technical/tax-guides/worldwide-corporate-tax-guide. நவம்பர் 29, 2024 அன்று அணுகப்பட்டது.

OECD (2024), ஆசியா மற்றும் பசிபிக் வருமான புள்ளிவிபரங்கள் 2024: ஆசியாவில் வரி வருமான அதிகரிப்பு, OECD பதிப்பு, பாரிஸ், https://doi.org/10.1787/e4681bfa-en

GRD: அரசாங்க வருமான தரவுத்தொகுப்பு." UNU-WIDER, 2023, https://www.wider.unu.edu/project/grd-government-revenue-dataset

இலங்கை உள்நாட்டு இறைவரித் திணைக்களம். 2022 ஆம் ஆண்டின் 45 ஆம் இல. வருமான வரிச் சட்டம், 2022, https://www.ird.gov.lk/en/publications/Acts_Income%20Tax_2017/IR_Act_No._45_2022_E.pdf

இலங்கை உள்நாட்டு இறைவரித் திணைக்களம். 2022-2023க்கான கூட்டிணைந்த வருமான வரி (CIT) மதிப்பீடு. 2023,

https://www.ird.gov.lk/en/Downloads/IT_Corporate_Doc/Asmt_CIT_003_2022_2023_E.pdf

இலங்கை பாராளுமன்றம். வழிவகைகள் பற்றிய குழுவின் இரண்டாவது அறிக்கை. 2023,

https://www.parliament.lk/uploads/comreports/1712049750029698.pdf

ஆய்வை மேற்கொண்டோர்: சதினி கல்ஹேனா மற்றும் அனுஷன் கபிலன்

தரவு காட்சிப்படுத்தல்: சதினி கல்ஹேனா