This article was compiled by Dr. Nishan de Mel.

Dr. Nishan de Mel is the Executive Director of Verité Research and an economist with extensive academic, policy and private sector experience. He taught and researched economics at Oxford and Harvard universities. He also served as the Executive Director at the International Centre for Ethnic Studies and the Sri Lanka Foundation Institute. He currently sits on multiple private sector boards and consults regularly as a strategist for some of the region’s largest firms.

Justice and good decision-making flows in part, from the discipline of public reasoning. The belief in democracy is anchored in the hope of harnessing the power of reasoned decision making that is openly and dialogically shaped by the informed engagement and consent of society systematically flouting that expectation is a recipe for political instability – and Sri Lanka’s post-colonial history is no stranger to that truth.

In the spirit of promoting public reasoning (that is both reasoning, and public), I published an op-ed last week showing why the Employees’ Provident Fund (EPF) was unjustly disadvantaged by the Domestic Debt Restructuring (DDR) proposed by the government of Sri Lanka. It presented an analysis (based on data in the public domain at that time) on the impact and injustice of exclusively targeting the bond holdings of retirement savings funds,causing huge losses to those who are forced to save 23% of their gross salary in the EPF and ETF.

The present article is written in the same spirit, to advance that previous analysis (published in the 6th July 2023 edition of the Daily Mirror, titled “Let’s Shield the EPF with the Instincts of Winston Churchill” - https://www.dailymirror.lk/opinion/Lets-Shield-the-EPF-with-the-Instincts-of-Winston-Churchill/172-262469) by adding two further calculations that grapple with new and limited information that has been released. The article will also respond to two critical questions that have been raised by various interlocutors – even if they have run shy of raising these questions publicly in an analytically reasoned form.

The concealment of information is hindering public reasoning

It is a curious thing indeed that the government of Sri Lanka is not able to explain analytically, with data, with integrity, with transparent assumptions, the impact and reasonableness of what it is proposing in the form of restructuring its domestic debt; despite it being a matter so momentous and important for the country which impacts all formal sector workers for the next 16 years and puts sustainable economic recovery in the balance. The lack of both supply, and demand, for such basic public accountability on government action is perhaps a pointer to why economic decision-making is systematically weak in Sri Lanka.

When that article was written, the only information made available was an unpublished PowerPoint presentation that was being circulated as the proposals presented to politicians by the Central Bank of Sri Lanka (CBSL). Since then, there has been a revised version of this PowerPoint presentation which has been shown to investors, and is now available on the Ministry of Finance website. A PowerPoint presentation remains the extent of rigour and disclosure from the highest levels of economic decision-making in the country. This is worryingly reminiscent of an economic recovery road map presented by the Central Bank in the last quarter of 2021, which had no analytical validity, and drove the country to economic disaster instead.

Contesting claims are not based on verifiable data or analysis

In the absence of adequate information, contrary claims can be entertained without means to arbiter between them. There have been press conferences and TV interviews, in which additional comments have been made by the CBSL and others on the merits of calculating those losses–I think prior to reviewing the analysis that was published in these pages last week.

Those comments and speculations upon them, don’t offer an alternative calculation or even a method of calculation on the loss to the EPF. We need to get beyond such “he said, she said” forms of public reasoning. It is unsafe to confidently expound the claim that the EPF is hardly impacted based on hearsay that is not transparently supported by data, by analysis, or by anything that is published by anyone.

Analysts at Verité Research (where I am privileged to work), have volunteered to help the process of public reasoning by building on that initial analysis I set out. They have developed further analytical scenarios on the losses to the EPF, which revise the initial scenario, based on information coming out in dribs and drabs from the government.

There is a working paper in progress with the full analysis, which will also make the data and computations accessible to the public – as was done in October 2022, when Verité Research published a paper on why domestic debt restructuring was necessary for Sri Lanka, and was therefore best done early and lightly (as a reprofiling only).

Three calculations on the loss to the EPF

This section summarises the original calculation, and two additional calculations based on attempting to better understand what is being offered as an outcome to the EPF.

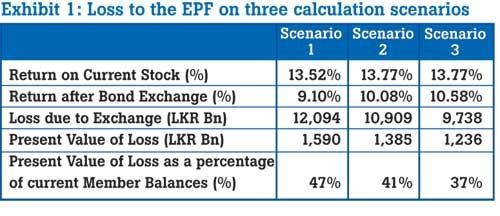

Calculation 1: sets out the assumptions and calculation previously published. The 13.52% return was arrived at by assuming only coupon cashflow returns on the weighted average portfolio of government bonds as of end May 2023. The EPF bond portfolio is expected to have the same returns (for reasons explained in the previous article). The 9.1% return used to calculate the return after the bond exchange was drawn from the government’s PowerPoint presentation. This is now superseded by the bond exchange offer, which has a higher yield that can be separately calculated.

Calculation 2: builds on calculation 1 with new information arising from the bond exchange offer advertised. Since the basis of exchange is not clear, this calculation assumes that new bonds will only replace the amortised cost of the existing portfolio's face value. The yield on the new bonds is then calculated to be 10.08%. It is compared with the yield on the current government portfolio of at 13.77% (which is larger than the coupon cashflow return).

Calculation 3: follows calculation 2 but assumes that new bonds will replace the full face value of the existing portfolio (which is more than the amortised cost). The yield on the new bonds is then calculated to be 10.58%.

In calculating the present value of the accrued loss by 2038, we have taken the higher yield as the discount rate. This gives a lower present value of the loss than if the discount rate was an average of the two yields being compared.

On these three calculations, the loss to the EPF by 2038 ranges from 37-47% of the current stock. The current stock of govt bonds with the EPF at the end of July 2023 is assumed to be of the same value as of the EPF fund balance as at the end of 2022.

Exhibit 1: Loss to the EPF on three calculation scenarios

The loss to the returns on the EPF through a bond exchange is a pre-tax calculation. Taxes are imposed by the government and subject to changes from time to time, but the bond exchange offer does not have a floating rate based on taxes – it is a fixed offer.

In an article published this week by a former deputy governor of the Central Bank (published in the 10th July 2023 edition of the Daily FT, titled “The misunderstood taxation of EPF and other superannuation funds”), it is explained that the EPF returns were not taxed prior to 1989 and were taxed only at 10% till 2017, after which it has been taxed at 14%. These tax rates can change in the future as well, and there are, in any case, additional layers of taxes in the form of exit taxes, which can apply differently to different members based on their balances.

The question of low returns to the EPF in the past

A question that has been raised is whether the EPF can justifiably get a much lower yield than the weighted average yield on the outstanding government bonds. The short answer is: Yes, if there is corruption and abuse in the way the EPF is invested. But in that case, the priority would be to correct that, not entrench that unacceptable outcome for 16 years with the current bond exchange.

It is also not clear if the reduced return to the EPF is due to other manipulations of the fund outside the bond market, as was discovered in the forensic audits published in 2019. In which case, they could go on unabated, causing the returns to the EPF to be lower than advertised. The current bond exchange only offers a specific return on the bonds, not on other investments of the EPF, which could have driven the losses, while the bonds were making higher returns.

The current offer, therefore, is not a guarantee of the final returns credited to the EPF on its total portfolio. All this can be easily resolved when the Central Bank publishes the bond portfolio as required by both the EPF law and principles of transparent trusteeship.

The question of future yields being as high as current yields

Another question being raised is whether we can reasonably assume the EPF would get the same average yields in the future till 2038 as the yield on the government bond portfolio at present.

The best indicator of the expected future yield is the yield at which the long-term bonds are traded in the market at present. To decipher that, we can take a look at the Sri Lankan

market or the international market.

On July 10th, in the Sri Lankan market, after the DDR risk on the rest of the domestic market was removed, the lowest quoted yield for bonds maturing in 2032 was 14% on the buy side and 13.5% on the sell side. If there were to be tenures beyond that, they are likely to be at a higher yield, with the expectation of yield curves being upward sloping, especially with the higher risk on maturities that are beyond the planning horizon of the current plans agreed with the IMF.

In the international bond markets (which Sri Lanka is expected to re-enter) the yields at which Sri Lanka can expect to issue bonds, even after recovering credit ratings, can be calculated by adding the risk premium expected over US treasury bonds, which is around 6 percent for a B rating (Source:World Government Bonds - Current Spreads). The current IMF programme also forecasts an average depreciation rate of about 6% for the next five years. Average rates on USD bonds for 5, 7, 10 and 20 years is about 4% (Source: US department of treasury). All that takes the expected cost of Sri Lankan ISBs to a yield of around 16% in LKR terms.That means the marginal cost of issuing domestic debt could go up towards 16% before it is optimal to issue ISBs.

If the government entertains optimism that defies the market expectations about future yields, it is possible for the government to offer the EPF an indexed bond that does not penalise the EPF if the government’s optimism is not borne out. The bond exchange can then be changed to simply offer the EPF a yield that is based on the weighted average cost of lending to the rest of the market.

In 2019, the CBSL made a couple of claims to argue that the EPF should resume investing in the stock market (as new investments had been halted for several years due to the corruption scandals). At the time, Verité Research analysed those claims and published the following insight: Flawed rationale behind EPF re-entering the stock market (https://www.veriteresearch.org/publication/flawed-rationale-behind-epf-re-entering-the-stock-market/). The analysis by Verité has proved correct, but was ignored, as CBSL entered the stock market. The Sri Lankan people need another forensic audit to find out the fate of their retirement savings, quite outside the DDR consequences.

Link to the original article published on the Daily Mirror Column.

https://www.dailymirror.lk/opinion/Calculating-the-Loss-to-the-EPF-from-Proposed-DDR/172-262908