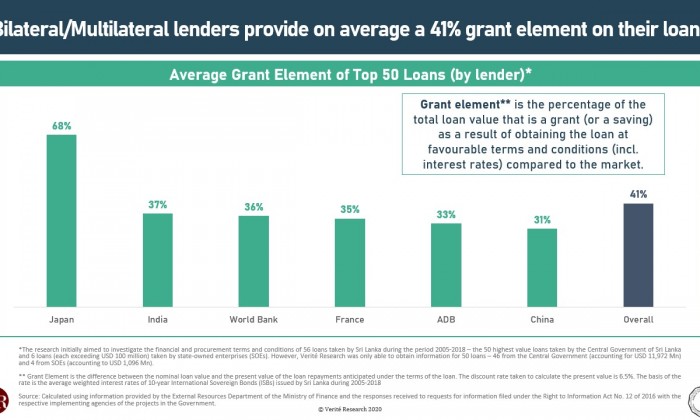

Recently Verite Research held a seminar on the potential (non) concessionality of concessional loans. This series summarizes the key findings. The first infographic compares the grant element of key lenders. A higher grant element indicates a more concessional loan.

The concessionality from the grant element of loans are impaired when procurement practices are tied. 28 of the 35 Bilateral loans assessed by Verite Research consisted of a tied element. All assessed loans from China & India were tied.

Of the 28 bilateral tied loans assessed, 13 were in the form of unsolicited proposals.

“Tying” loans to procurement from contractors of the lending country can lead to cost escalations as it prevents competitive bidding and finding the lowest cost suppliers. These cost escalations could erode the grant element of these loans, making them adverse.

82% of the loans assessed would have their grant element negated with a cost escalation of less than 50%.

The weighted average non-concessional threshold is the lowest for loans from China at 33%.