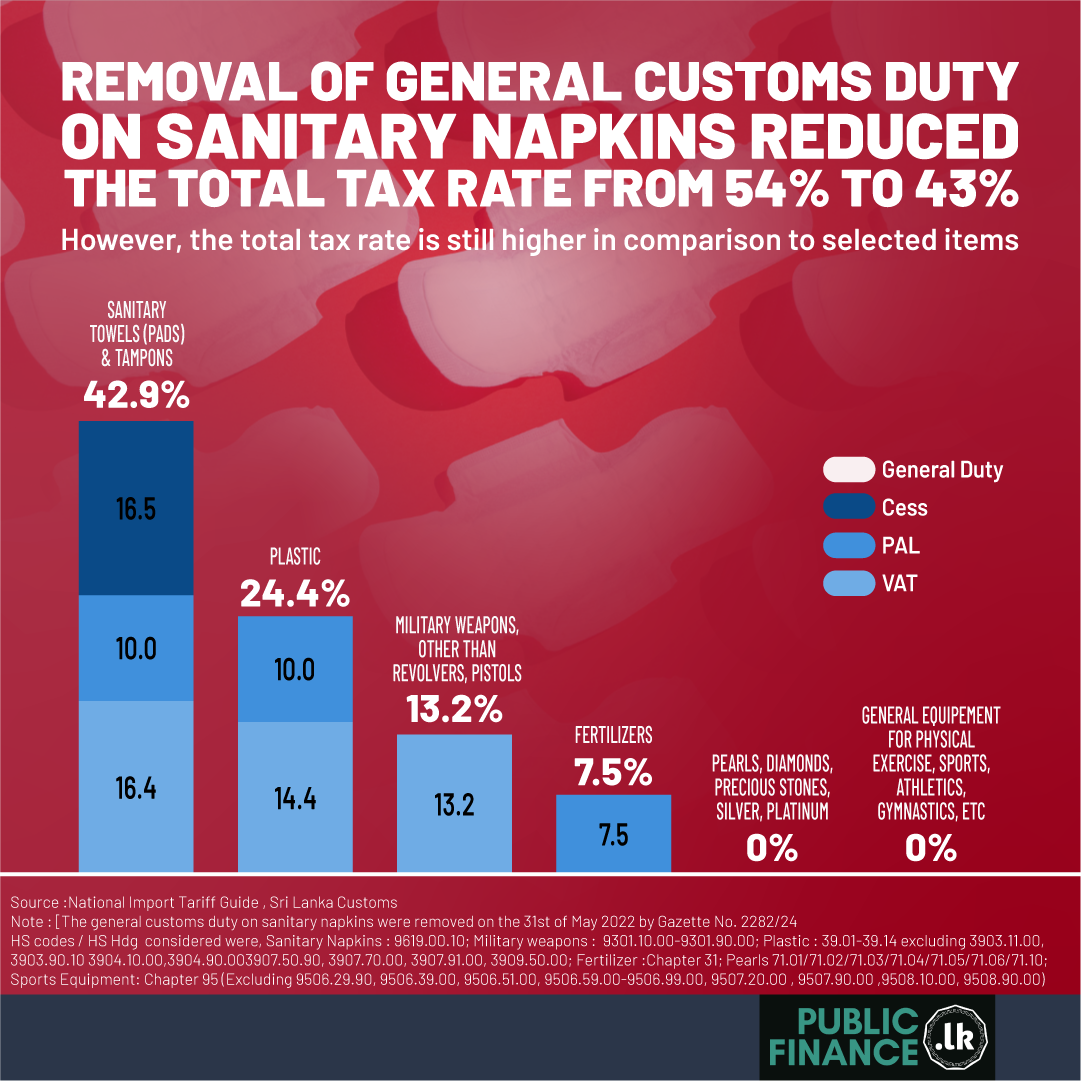

On the 31st of May 2022 the general customs duty on sanitary napkins were removed and VAT rate was increased from 8% to 12%.

The revision resulted in the total tax rate on sanitary napkins falling to 42.8% from 53.6%. However, the total tax rate is still higher in comparison to selected items.

Sources :

Taxes were calculated based the computation formula for imported goods published by the Sri Lanka Customs, available at : https://www.customs.gov.lk/wp-content/uploads/2021/07/15.formula_2011.pdf

Tax rates applicable for each product as at 21st July 2022 are as follows,

|

HS Code / HS Hdg |

Product |

Pref Duty |

Gen Duty |

VAT |

PAL |

Cess |

|

9619.00.10 |

- |

- |

12% |

10% |

15% |

|

|

93.01 |

- |

- |

12% |

Exempted |

- |

|

|

39.01-39.14 |

- |

Free |

12% |

10% |

- |

|

|

Chapter 31 |

Free |

Free |

Exempted |

7.50% |

- |

|

|

71.01/71.02/71.03/71.04/71.05/71.06/71.10 |

Free |

Free |

Exempted |

Exempted |

- |

|

|

Chapter 95 ( Excluding 9506.29.90, 9506.39.00, 9506.51.00, 9506.59.00-9506.99.00, 9507.20.00 , 9507.90.00 ,9508.10.00, 9508.90.00 ) |

General Equipment for physical exercise , sports, athletics, gymnastics etc. |

Free |

Free |

Exempted |

Exempted |

- |