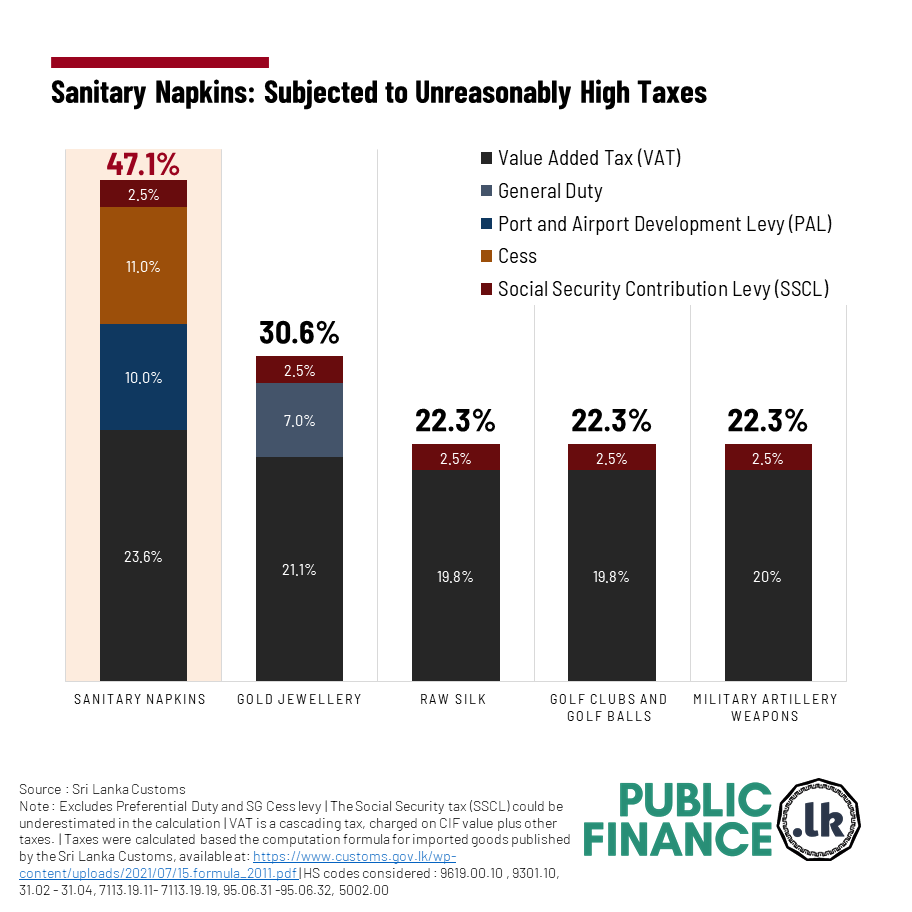

The total tax burden on Sanitary napkins is 47.1%, this is significantly higher than the tax burden of selected non-essentials items, gold jewelry, raw silk, golf clubs and golf balls and military artillery weapons.

Taxes were calculated based the computation formula for imported goods published by the Sri Lanka Customs, available at: https://www.customs.gov.lk/wp-content/uploads/2021/07/15.formula_2011.pdf

Source: Sri Lanka Customs

Tax rates applicable for each product as of 27 Feb 2024 are as follows,

|

HS Code / HS Hdg |

Product |

Gen Duty |

VAT |

PAL |

Cess |

SSCL |

|

9619.00.10 |

- |

18% |

10% |

10% |

2.5% |

|

|

9301.10 |

Artillery weapons (for example, guns, howitzers and mortars) |

- |

18% |

Exempted |

- |

2.5% |

|

31.02 - 31.04, |

Mineral or chemical fertilizers containing either nitrogenous, phosphatic or potassic |

- |

18% |

Exempted |

- |

Exempted |

|

7113.19.11- 7113.19.19 |

Articles of jewellery and parts thereof, of precious metal or of metal clad with precious metal. |

7% |

18% |

Exempted |

- |

2.5% |

|

95.06.31 -95.06.32 |

|

18% |

Exempted |

- |

2.5% |

|

|

5002.00 |

- |

18% |

Exempted |

- |

2.5% |