The Fiscal Management (responsibility) Act (FMRA), No. 3 of 2003 is a piece of legislation intended to enact fiscal rules in Sri Lanka. . The Act provides for measures to ensure greater transparency and reporting of fiscal performance to facilitate greater public scrutiny of the same.

The FMRA sets out three key fiscal limits to be achieved by specified dates.

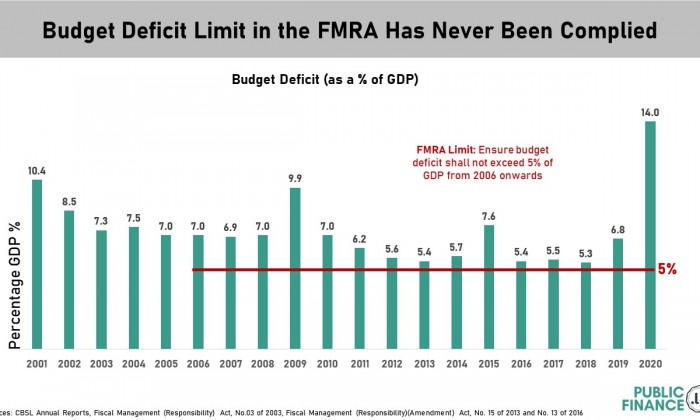

First, the original FMRA, enacted in 2003, prohibited the budget deficit from exceeding 5% of GDP from 2006 onward. However, the budget deficit has consistently remained above the set limit, including the proposed budget deficit for 2021. Whilst other limits in the FMRA were revised with subsequent amendments to the act, this particular limit has not been amended.

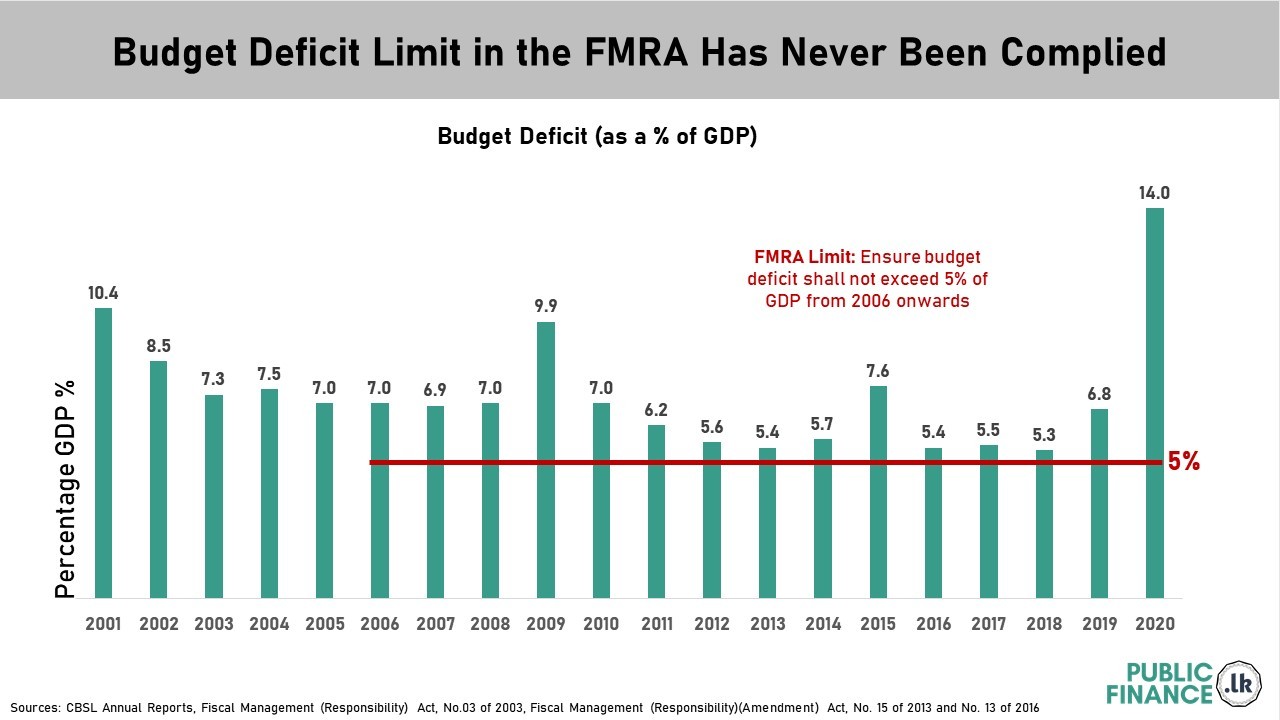

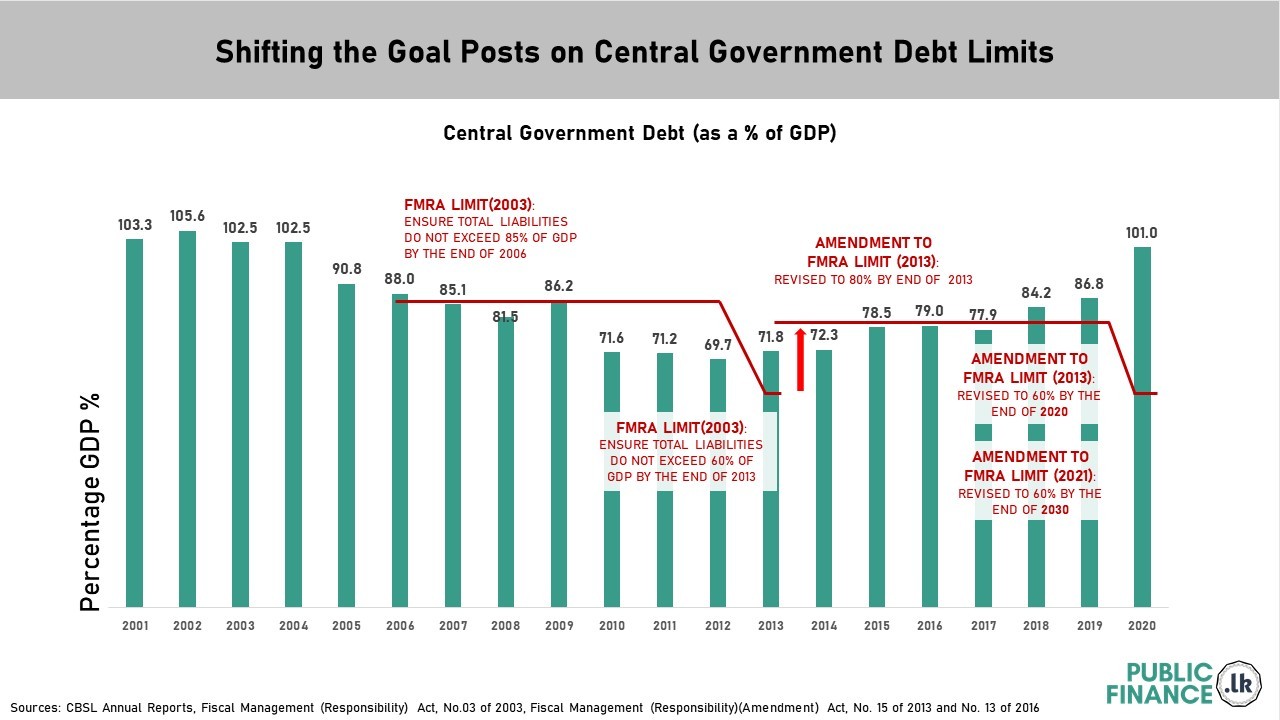

Second, the FMRA also sets a limit on total liabilities of the government, i.e. the country's central government debt. The original legislation of 2003 specifies a central government limit of 85% of GDP by end 2006. It further specifies that central government debt should not exceed 60 percent of GDP by the end of 2013. However, this limit was increased through an amendment to the act in 2013. The initial limit set at 60 percent was increased to 80 percent in 2013 and the time frame for compliance was extended till 2020. Since the 2020 timeframe was breached, in June 2021, the FMRA was further amended to extend the central government debt limit of 80 percent of GDP till 2030.

Third, the FMRA also sets limits on the government's contingent liabilities.. This primarily refers to sovereign guarantees which require the government to repay a loan in the event of default. Sovereign guarantees are typically given for some liabilities incurred by State Owned Enterprises. The original FMRA in 2003 set a limit for guarantees of 4.5% of GDP. As government guarantees increased, the limits were increased to enable compliance. The limits were increased to 7% and 10% in 2013 and 2016 respectively. In June 2021, FMRA was amended to increase the limit further to 15% of GDP.

The Auditor General has consistently raised concerns regarding the breach of the FMRA in recent Audit Reports of the Ministry of Finance financial statements.

The regular violations of the FMRA and amendments to the Act to accommodate fiscal profligacy result in an erosion of credibility of the executive. Parliament too has consistently failed in its responsibility to ensure that the executive is held accountable for such failures. These transgressions undermine the credibility of the very institutions that are intended to provide credibility.