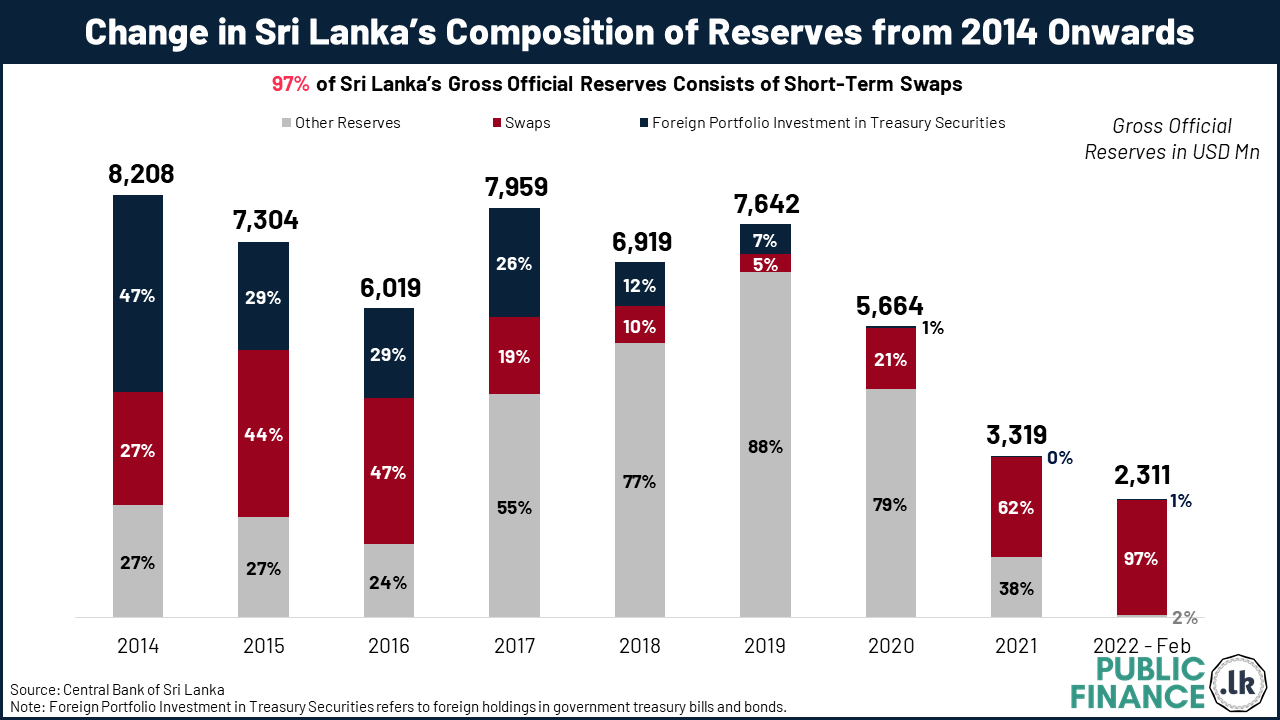

The reported gross official reserves as of February 2022 stood at USD 2,311 MN, out of which 98% (USD 2,242 MN) consisted of short-term swaps maturing within 12 months.

Whilst the quantity of reserves is important it is equally necessary to consider the quality of reserves. Short term swaps and foreign investment in government securities are essentially short-term in nature, and portfolio investments in government securities are also volatile.

In an ideal scenario, reserves should comprise largely of non debt creating inflows such as FDI and current account surpluses. Sri Lanka however has consistently run current account deficits in its balance of payments. The second best option would be long-term stable borrowings (such as ISBs) that have a significantly longer repayment duration than short term swaps or volatile portfolio investments. Such instruments provide a greater degree of stability and longevity for a country’s reserves.