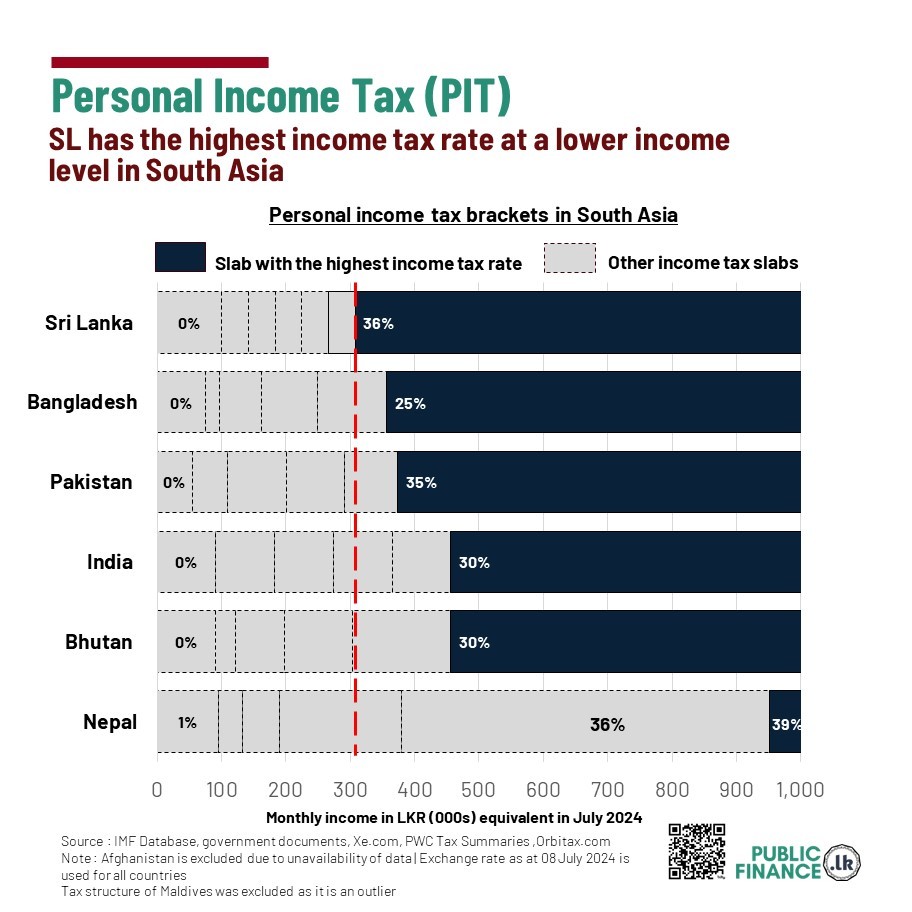

Sri Lanka imposes its highest tax rate at a relatively lower income threshold compared to other South Asian countries. Individuals earning over LKR 308,333 per month are subject to a steep 36% tax rate, making Sri Lanka the fastest in the region to reach its top tax bracket - the highest tax rate at which income is taxed. In comparison, India and Bhutan apply their top tax rate of 30% on incomes around LKR 457,000 and LKR 456,000, respectively, while Pakistan’s 35% rate applies to incomes above LKR 374,000. Bangladesh, with a lower top tax rate of 25%, taxes incomes above LKR 357,000. Nepal, the only country with a higher top tax rate than Sri Lanka, charges 39% on incomes over LKR 950,958, while its 36% rate applies to earnings above LKR 381,000—still higher than Sri Lanka’s threshold.

Table 1: Upper personal income tax boundary in South Asia (local currency and LKR equivalent)

|

Country |

Upper income boundary in Local Currency |

LKR equivalent of Upper income boundary*

|

Tax rate |

|

Sri Lanka |

1,200,000 |

1,200,000 |

36% |

|

Bangladesh |

1,650,000 |

4,281,420 |

25% |

|

Pakistan |

4,100,000 |

4,486,220 |

35% |

|

India |

1,500,000 |

5,478,600 |

30% |

|

Bhutan |

1,500,000 |

5,466,435 |

30% |

|

Nepal |

5,000,000 |

11,411,500 |

39% |

|

Maldives |

2,400,000 |

47,329,920 |

15% |