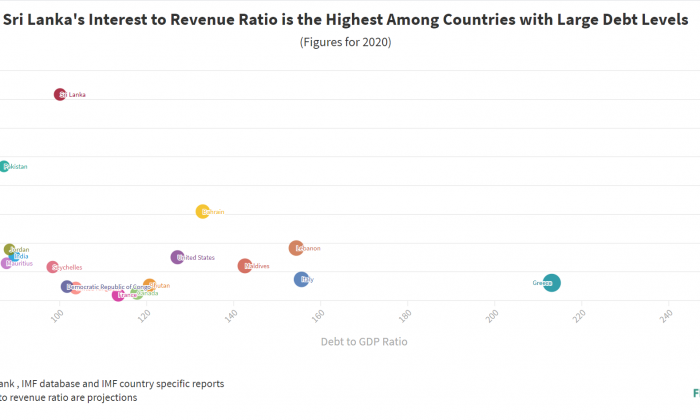

The graph shows the gross debt as a percentage of GDP and interest payments as a percentage of revenue in 2020 for countries with the largest debt levels.

A high debt to GDP ratio may not be very problematic as long as the government has the means of servicing its debt (by maintaining the market’s confidence) and its interest costs are not exceedingly high. Sri Lanka’s debt burden measured in terms of Debt to GDP is comparable to countries such as Greece, Japan or even the United States.

However, compared to all the countries for which data is available in the world, Sri Lanka has the highest percentage of interest payments compared to its government revenue in 2020. Sri Lanka’s interest cost to revenue ratio reached an unprecedented level of 71.7% in 2020. While Sri Lanka pays more than two thirds of its revenue as interest cost, countries with much higher debt to GDP Ratios such as Japan pay only 8.2% of its revenue as interest cost. (More details on the ratio in previous years : https://publicfinance.lk/en/topics/Interest-Cost-Accounts-for-717-percent-of-Government-Revenue-1625468514 ).

Note: The countries were selected based on the debt to GDP ratio exceeding 80% and were narrowed down based on data availability for 2020.

Sources : Ministry of Finance Annual Report 2020 and 2019

IMF - World Economic Outlook ,2021 https://www.imf.org/external/datamapper/GGXWDG_NGDP@WEO/OEMDC/ADVEC/WEOWORLD

|

Country |

Source of Interest Payments / Interest to Revenue Ratio |

|

UK |

|

|

Greece |

|

|

Italy |

|

|

Maldives |

|

|

Bahrain |

|

|

United States |

|

|

Bhutan |

Ministry of Finance: National BUDGET FINANCIAL YEAR 2019-2020 |

|

Canada |

|

|

France |

|

|

Democratic Republic of Congo |

|

|

Seychelles |

|

|

India |

|

|

Jordan |

|

|

Mauritius |

|

|

Tunisia |

|

|

Pakistan |

Government of Pakistan , Finance Division : FEDERAL BUDGET 2020-21 |

|

Japan |