Net Foreign Assets (NFA) of a country's monetary authority refers to the difference between gross foreign reserve assets and liabilities related to foreign reserves. Typically, such liabilities include the Central Bank's liabilities to the IMF, swaps, and any other reserve related liabilities. In August 2021 the Central Bank's NFA was LKR –84 billion. The Central Bank has published data on CBSL NFA since 1995 and this is the first time the CBSL's NFA has turned negative during this period.

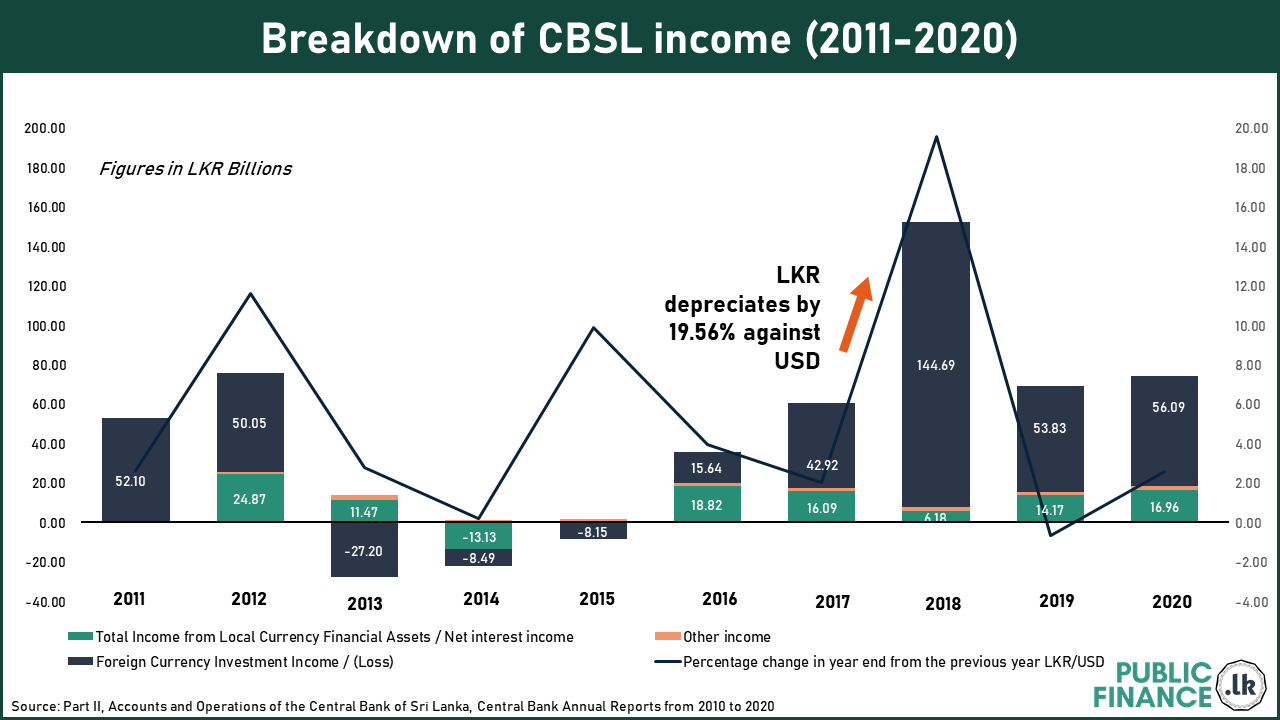

The Central Bank's foreign assets have been a key contributor to the annual income position of the Central Bank. Whilst the Central Bank's objective is not to make profits, the annual income of the Central Bank does have fiscal implications. In recent years when the CBSL has made a profit, a component of that has been transferred to the treasury as a source of non-tax revenue to the government.

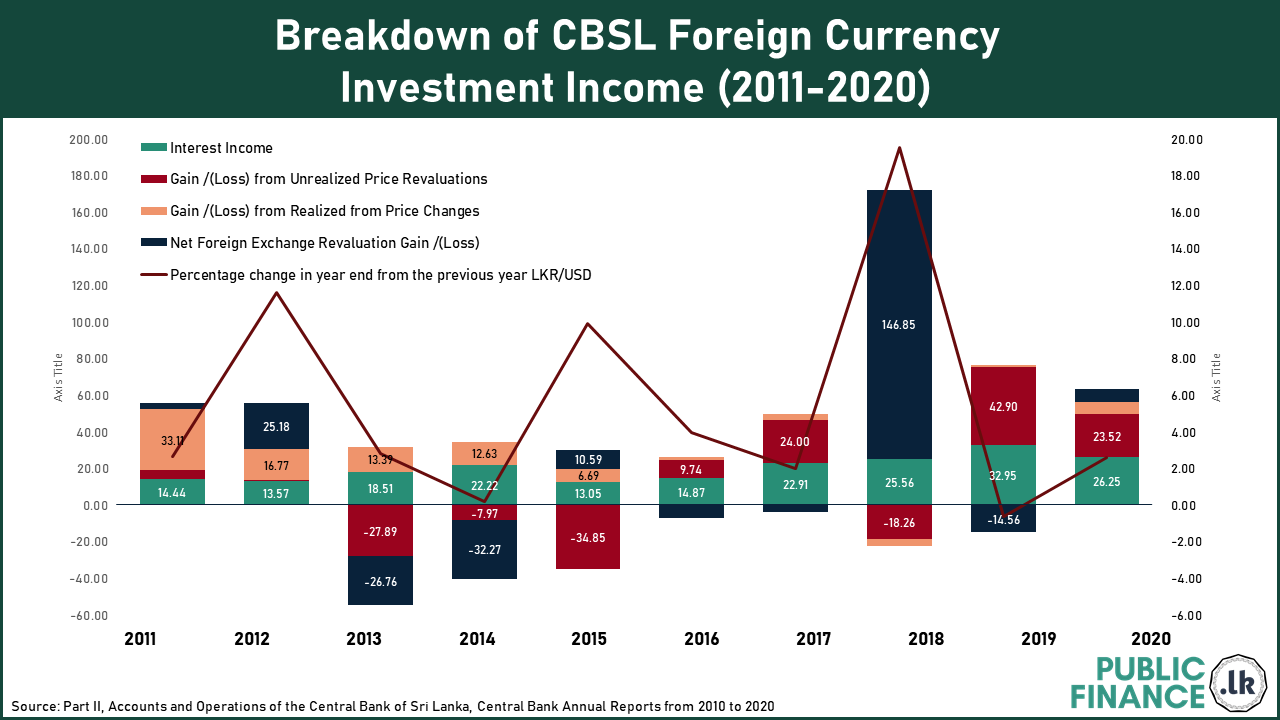

It is evident from this infographic that forex revaluation gains on the CB's foreign assets have a significant impact on annual profit of the institution. Whenever the Sri Lankan rupee depreciates, the resulting revaluation of foreign assets translated into Sri Lankan rupees has a positive impact on the Central Bank’s income statement. For instance, in 2018, when there was a sharp depreciation of the currency, there was a substantial exchange gain in the CBSL income statement that year. However, given the recent downturn in the NFA position of CBSL, this is likely to have an adverse impact on Central Bank income statement going forward even if the currency continues to depreciate.