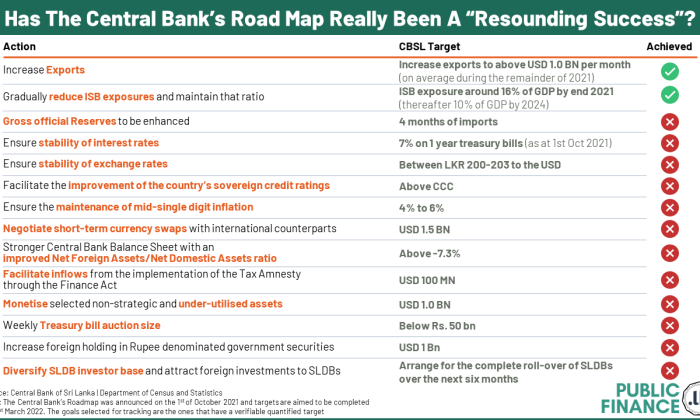

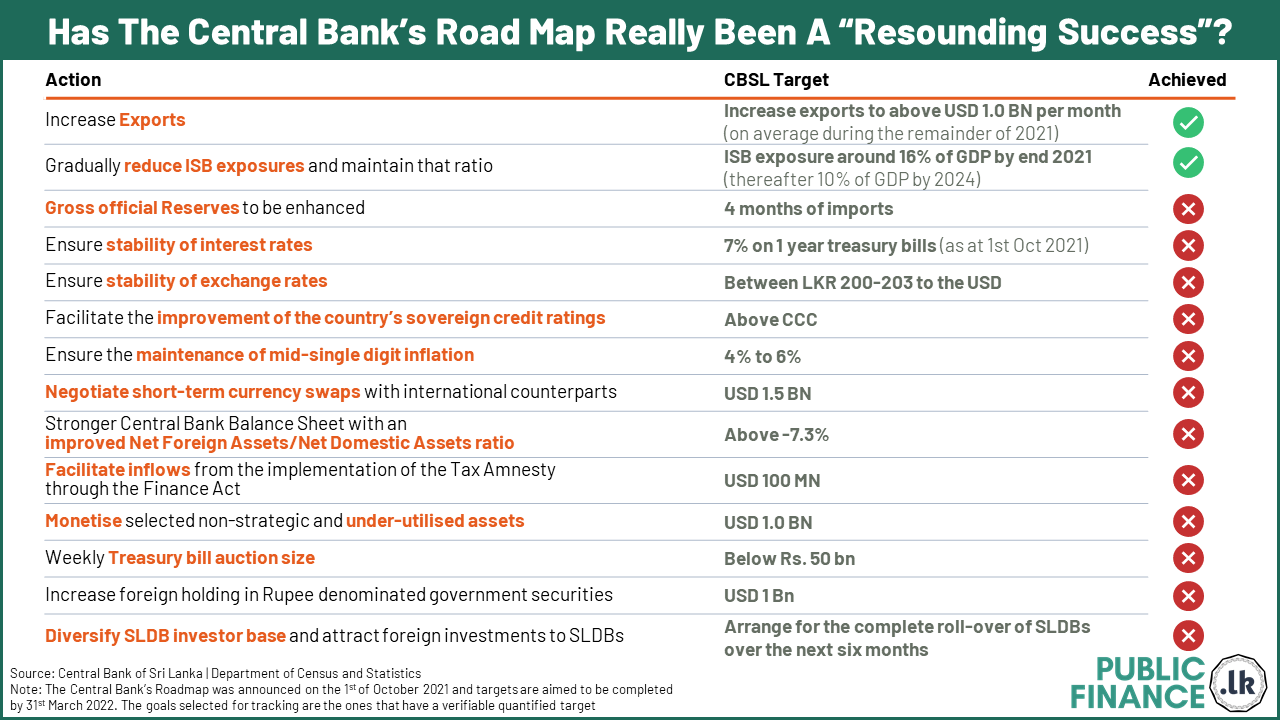

In October 2021, the Central Bank governor announced a six-month road map to ensure macroeconomic and financial system stability.

14 Goals that had a verifiable quantified target were selected and tracked to identify if the said targets were achieved.

Following are the results of the study.

Details of each target and the status of the target as at end of February 2022 are listed down in Table 1.

|

# |

Action |

Target by end March 2022 |

As mentioned in the plan |

Achieved by end Feb |

|

1 |

Increase Exports |

Increase exports to above USD 1.0 BN per month (on average during the remainder of 2021) |

Monitor forex flows (exports and investments) through the Presidential Task Force (Target to increase exports to above USD 1.0 bn per month, on average during the remainder of 2021) |

Average Monthly Exports - USD 1.2 bn |

|

2 |

Gradually reduce ISB exposures and maintain that ratio |

ISB exposure around 16% of GDP by end 2021 and thereafter to 10% of GDP by 2024 |

Gradually reduce ISB exposures towards to around 16% of GDP by end 2021 thereafter 10% of GDP by 2024 and maintain that ratio |

ISB exposure stood at 15.9% of GDP by end 2021. |

|

3 |

Gross official reserves to be enhanced |

4 months of imports |

Gross official reserves to be enhanced to cover a minimum of 4 months of imports |

Usable reserves have been reduced from 1.5 months to 0.4 months of imports. |

|

4 |

Ensure stability of interest rates |

7% on 1 year treasury bills (as at 1st Oct 2021) |

Ensure stability of interest rates and the exchange rate |

1-year primary market treasury bills rate increased by 527 basis points |

|

5 |

Ensure stability of exchange rates |

Maintain exchange rate between LKR 200-203 to the USD |

Ensure stability of interest rates and the exchange rate |

Exchange rate depreciated by 48% by end of February. |

|

6 |

Facilitate the improvement of the country’s sovereign credit ratings |

Maintain fitcch credit ratings above CCC |

Facilitate the improvement of the country’s sovereign credit ratings |

Fitch downgraded Sri Lanka to CC in December 2021 |

|

7 |

Ensure the maintenance of mid-single digit inflation |

Maintain inflation around 4% to 6% |

Ensure the maintenance of mid-single digit inflation - 4% to 6% |

Inflation for the month of March 2022 worsened to 18.7%. |

|

8 |

Negotiate short-term currency swaps with international counterparts |

USD 1.5 BN |

Negotiate short-term currency swaps with international counterparts (Target: USD 1.5 BN) |

Based on information available in the public domain, Sri Lanka was only able to negotiate USD 400 MN swap from India. The CNY 10 billion swap (USD 1.5bn) was negotiated and agreed in March 2021 and therefore is not considered a new arrangement even though it was drawn down in December 2021. |

|

9 |

Stronger Central Bank Balance Sheet with an improved Net Foreign Assets/Net Domestic Assets ratio |

To maintain the net forein assets/net domestic asset ration above -7.3% |

Stronger Central Bank Balance Sheet with an improved Net Foreign Assets/Net Domestic Assets ratio |

The ratio worsed from -7.3% in Oct 2021 to -8.4% in Dec 2021 |

|

10 |

Facilitate inflows from the implementation of the Tax Amnesty through the Finance Act |

USD 100 MN |

Facilitate inflows from the implementation of the Tax Amnesty through the Finance Act (Target: USD 100 MN ) |

No information available in the public domain on inflows received through the tax amnesty |

|

11 |

Monetise selected non-strategic and under-utilised assets |

USD 1.0 BN |

Monetise selected non-strategic and under-utilised assets (Target: USD 1.0 BN) |

There is no information available in the public domain that confirms confirms any proceeds from asset divestments. |

|

12 |

Weekly Treasury bill auction size |

Below Rs. 50 BN |

Weekly Treasury bill auction size of below Rs. 50 bn |

The weekly accepted treasury bills bids averaged to LKR 62 BN from Oct 2021 to March 2022 |

|

13 |

Increase foreign holding in Rupee denominated government securities |

USD 1 BN |

Foreign holding of 2.5% in Rupee denominated government securities (USD 1 BN) |

Foreign holding in Treasury bills and bonds increased by LKR 789 MN (USD 3.94 MN) |

|

14 |

Diversify SLDB investor base and attract foreign investments to SLDBs |

Arrange for the complete roll-over of SLDBs over the next six months |

Diversify SLDB investor base and attract foreign investments to SLDBs – arrange for the complete roll-over of SLDBs over the next six months |

SLDBs value fell from USD 2,305 Mn to USD 1,835 Mn, which is only a 55% rollover from Oct 21 to March 22 |