The COVID-19 pandemic has resulted in severe macroeconomic distress across the global economy. Countries with pre-existing economic stresses, including Sri Lanka, face additional vulnerability. Sri Lanka entered this crisis with a weak fiscal position and a challenging balance of payments (BoP) outlook. At the beginning of 2020 Sri Lanka had maturing external liabilities of USD $ 6 billion with foreign currency reserves of USD $ 7.6 billion. Therefore, Sri Lanka would have to raise finances through global bond markets in order to meet external debt obligations whilst maintaining sufficient reserves[i] to finance trade and other regular outflows.

However, Sri Lanka’s ability to access global markets was constrained due to the pandemic resulting in both a flight to safety among global investors and deteriorating internal fiscal dynamics. Sri Lanka’s pre-existing fiscal weakness meant that access to financial market was already limited. The sovereign credit rating was given a negative outlook following tax cuts in December 2019, which further weakened the fiscal outlook. Since the pandemic in March 2020, Sri Lanka’s sovereign debt has been trading at deep discounts with secondary market yields more than double what they were at the end of 2019, albeit on low volumes, signifying the increasing difficulty of accessing global financial markets.

It is in this context that Sri Lanka has sought emergency credit assistance from the International Monetary Fund (IMF). In this note Verité Research examines some of the options for emergency credit from the IMF and evaluates which options would work best to address Sri Lanka’s pressing needs.

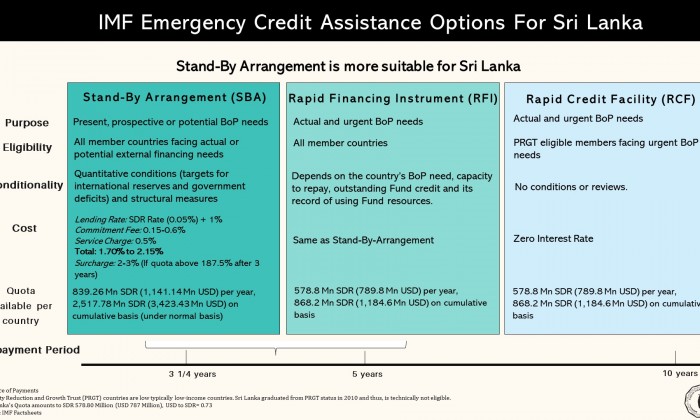

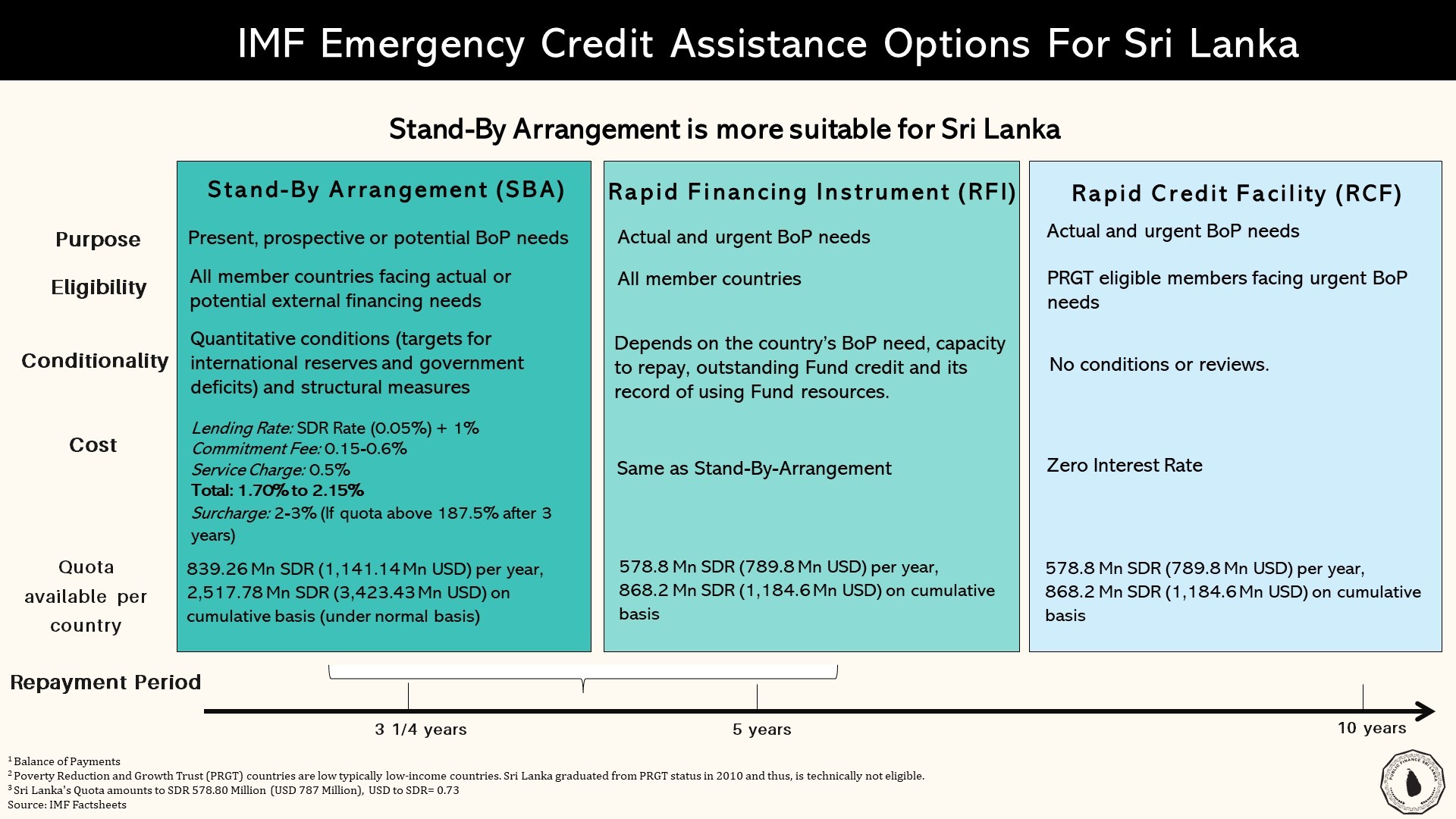

The following are IMF’s short-term lending facilities which are available to countries that face balance of payments challenges: (1) Stand-by Arrangements (SBAs); (2)Rapid Financing Instruments (RFIs); and (3) Rapid Credit Facilities (RCFs). (See Table 1: Short-term Emergency credit assistance from IMF).

Of these three lending facilities, Sri Lanka is not eligible for RCF. Although RCF has favorable terms, it is limited to Poverty Reduction and Growth Trust (PRGT) eligible members, that is, countries in the low-income bracket. Sri Lanka graduated from PRGT status in 2010 and thus, is technically not eligible for this facility.

The SBA and RFI are identical in terms of cost and repayment period. However, they differ based on loan quantum offered and on conditionalities. (See Table 1: Short-term Emergency credit assistance from IMF). Loan values are higher for a SBA than for a RFI. Sri Lanka last engaged in a SBA in 2009 during the global economic crisis.

The most important difference between an SBA and RFI is the conditionality attached to each. SBAs have a higher level of conditionality which is typically designed to address the root cause of the macroeconomic problem. The programme embeds quantitative targets on indicators such as Net International Reserves and Budget Deficits which are linked to disbursements. The country’s agreement to meet these targets signals to markets a commitment to address its macroeconomic challenges. This in turn helps restore market confidence in the economy and help a country regain market access. Sri Lanka’s most recent IMF programme was an Extended Financing Facility (EFF) from 2016-2019 – which entails a more in-depth, structural adjustment programme than a regular SBA.

Sri Lanka has sufficient reserves of USD 7.2 Bn in April to meet most significant external commercial obligations in 2020[ii], however reserves will be drawn down substantially. Sri Lanka has further external liabilities of USD $ 4 billion in 2021 as well[iii]. Therefore, regaining access to global bond markets is critical in early 2021 to ensure sufficient reserves to avoid default on liabilities in 2021.

An SBA will provide greater material signaling impact along with an added advantage of a higher volume of funds. Unlike a RFI, which will provide a lower quantum of funds with limited signaling impact. Given Sri Lanka’s immediate priorities, an SBA is more suited to Sri Lanka’s needs to ensure a faster return to global bond markets.

[1] IMF guidelines for reserve adequacy vary for different country circumstances – for Sri Lanka the most relevant would be i) 100% coverage of short term external debt ii) coverage of 3 months of imports. Sri Lanka’s short term external debt as at end 2019 was US$ 8.2 billion (9.8% of GDP) and 3 months of imports (based on 2019 imports) is US$ 4.9 bn. GUIDANCE NOTE ON THE ASSESSMENT OF RESERVE ADEQUACY AND RELATED CONSIDERATIONS, IMF, June 2016, available at: https://www.imf.org/external/np/pp/eng/2016/060316.pdf [Last accessed on 12 June 2020]

[1] Weekly Economic Indicator, Central Bank of Sri Lanka, 22 May 2020, available at https://www.cbsl.gov.lk/sites/default/files/cbslweb_documents/statistics/wei/WEI_20200522_e.pdf [ Last accessed on 12 June 2020]

[1] Annual Report, Ministry of Finance, 2019, available at http://www.treasury.gov.lk/documents/10181/12870/AR2019-Rev202200608-eng/1d200c0f-1b5d-41b0-8274-db754be20f0f [Last accessed on 12 June 2020][1] IMF Factsheets, IMF, available at https://www.imf.org/en/About/Factsheets/IMF-Lending [Last accessed on 12 June 2020]