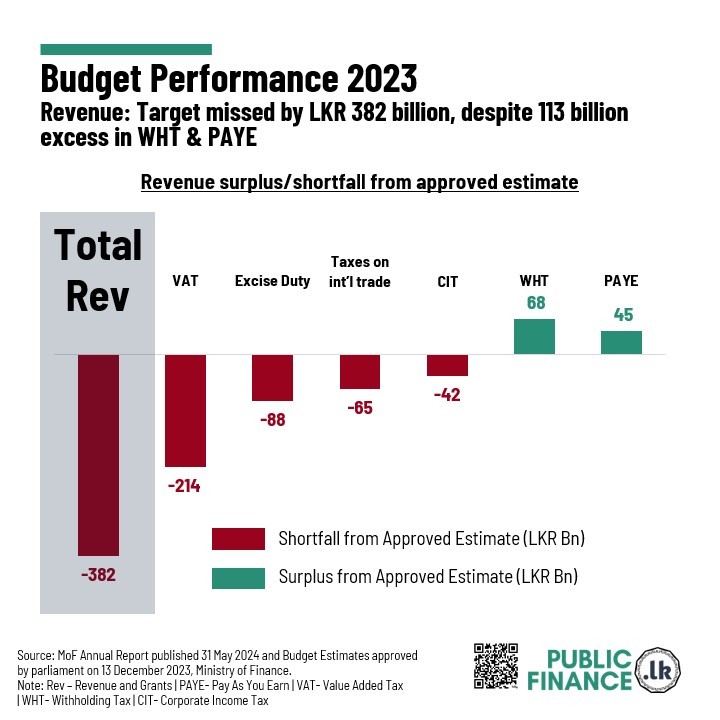

The Ministry of Finance Annual Report, released on 31st May 2024, shows that in 2023, total revenue including grants fell short of the Budget target by LKR 382 billion or 11%. In 2023, actual total revenue and grants amounted to LKR 3,074 billion, while the approved estimates set at the end of 2022 for 2023 were LKR 3,456 billion. Among the revenue components, VAT contributed the most to the shortfall, accounting for over half of the gap, missing its estimate by LKR 214 billion or 24%. Excise duty also significantly underperformed, falling short by LKR 88 billion.

Conversely, some revenue components exceeded their approved estimates. Revenue from Withholding Taxes and Pay-As-You-Earn (PAYE) taxes made surpluses of LKR 68 billion and LKR 45 billion, respectively, or 76% and 45% above the target. This increase could be due to the reintroduction of Withholding Taxes and PAYE at the beginning of 2023.

Exhibit 1: Government Revenue actuals compared against budgeted for 2023

|

Revenue |

2023 Revised Estimate |

2023 Actual |

Deviation (LKR Bn) |

Deviation |

|

Total Revenue and Grants |

3,456 |

3,074 |

(382) |

-11% |

|

VAT |

908 |

694 |

(214) |

-24% |

|

Excise Tax |

557 |

469 |

(88) |

-16% |

|

Taxes on international trade |

458 |

392 |

(65) |

-14% |

|

Corporate Income Tax |

597 |

555 |

(42) |

-7% |

|

Withholding Tax |

90 |

158 |

68 |

76% |

|

Pay-As-You-Earn |

100 |

145 |

45 |

45% |

Source

Ministry of Finance' FINAL BUDGET POSITION REPORT (ANNUAL REPORT) 2023' at https://www.treasury.gov.lk/api/file/ad12f7fa-d2db-43d4-9daa-9270ee7b7cac [last accessed 7 August 2024].

Ministry of Finance 'Budget Estimates 2023' at https://www.treasury.gov.lk/api/file/e286b9e4-59b1-406f-b324-12f2b46969f2 [last accessed 7 August 2024].