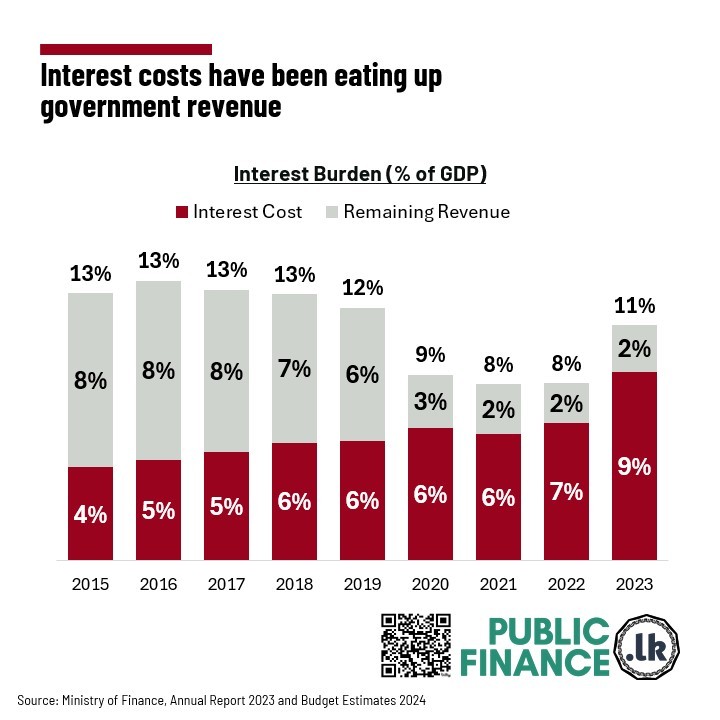

In 2023, for the first time in history, the government spent 9% of its GDP on interest payments, which took up 80% of the government revenue.

A high interest-to-revenue ratio can be severely detrimental to a country's debt sustainability. This high ratio creates a need to borrow more, undermining debt sustainability and leaving limited revenue for essential government spending and investments.

The interest-to-revenue ratio has increased in recent years for two reasons.

Revenue Fell Due to Tax Reductions in 2019

Government revenue as a share of GDP dropped from 12% in 2019 to 9% in 2020. This is mainly due to the newly elected government lowering several tax rates in 2019. Thus, the interest share of revenue increased to 71% in 2020 from 47% in 2019, even though the interest payments as a share of GDP remained at 6%.

Interest Costs Surged Due to High Interest Rates and More Government Debt

Interest expenditure as a share of GDP increased to 9% in 2023 from 6% in pre-2021. This is due to (1) the domestic interest rates skyrocketing to above 25% post-2021 from less than 10% in the prior years - mainly owing to tight monetary conditions and lack of access to foreign financing. (2) Central government debt also increased significantly from 81.9% in 2019 to 114.2% in 2022, leading to higher interest expenditure as the government had to pay more interest on the excessive debt obtained.

It is also important to note that this interest figure would have been much higher if the accrued interest expenditure on defaulted foreign debt had been included.

Sources

Ministry of Finance. Annual Report (2023) at https://www.treasury.gov.lk/web/annual-reports/section/2023 [last accessed 26 June 2024].

Ministry of Finance. Budget Estimates (2024) at https://www.treasury.gov.lk/web/budget-estimates/section/budget%20estimates%202024 [last accessed 26 June 2024].