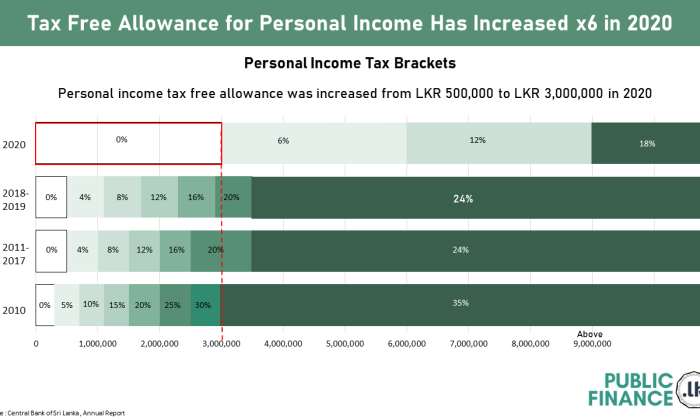

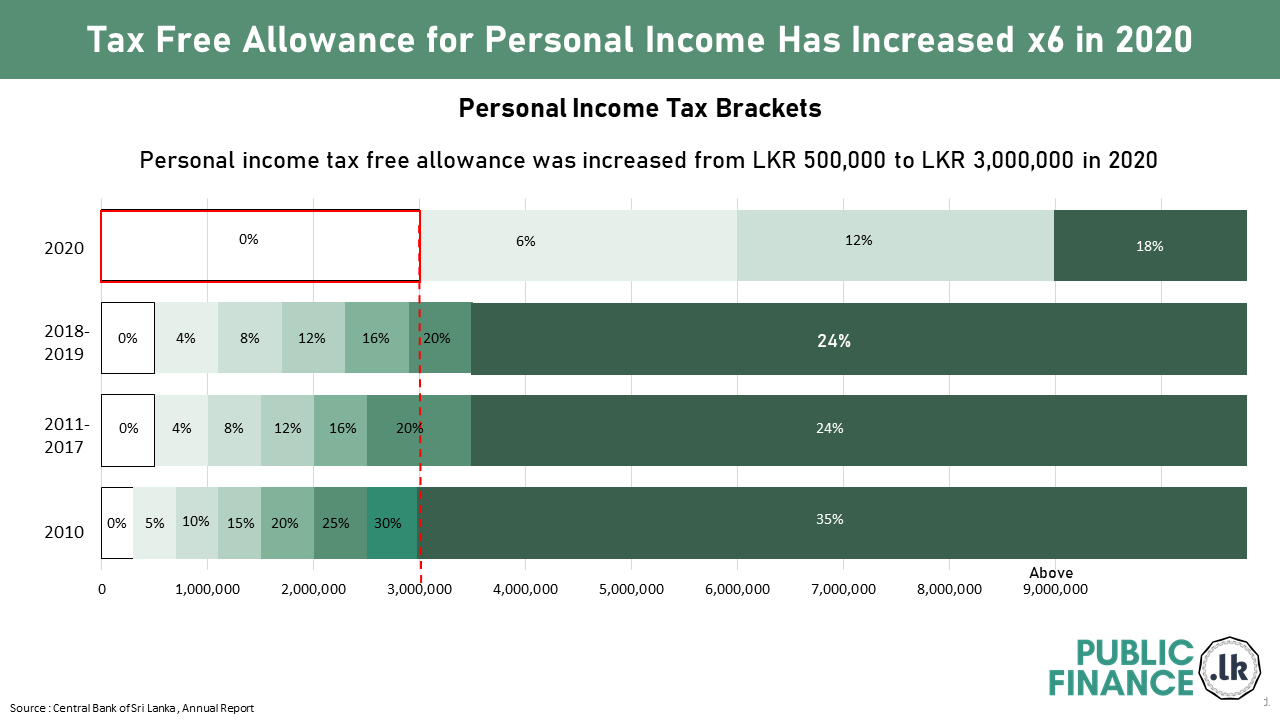

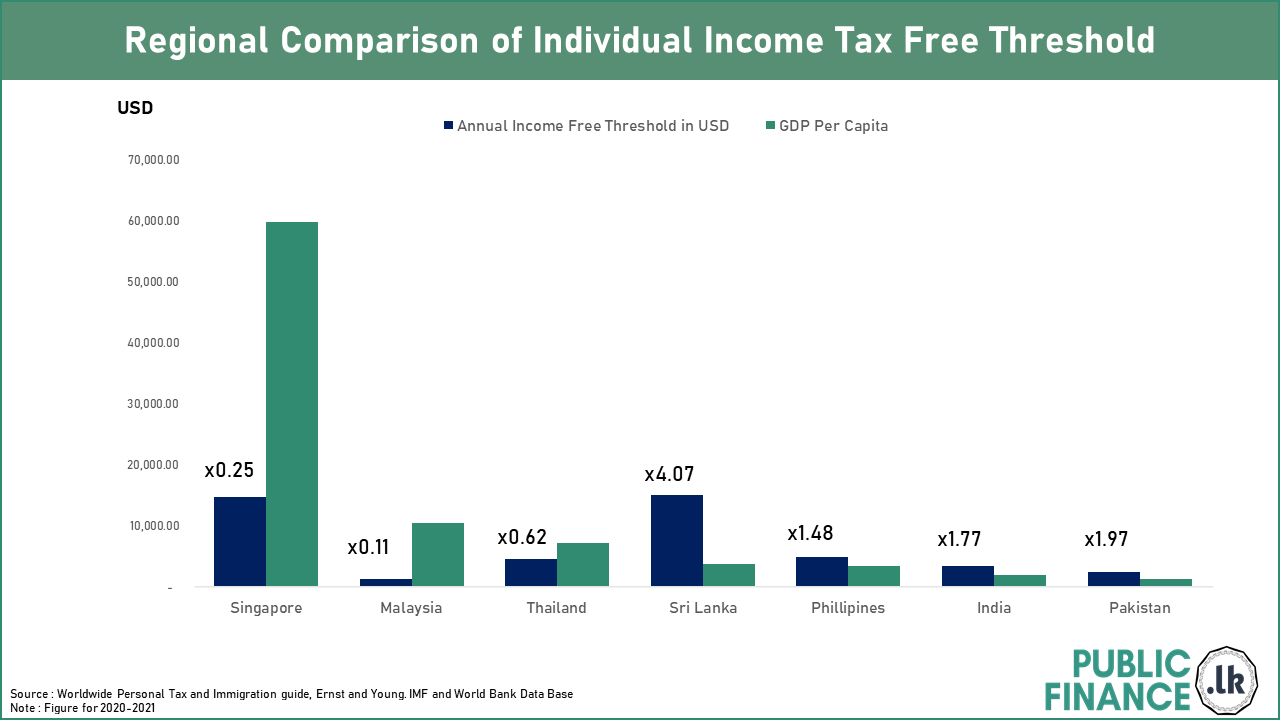

Sri Lanka’s personal income tax regime considers employment income, business income, investment income and other income as taxable income.In January 2020, there were major changes made to the personal income tax regime , the key changes pertaining to the threshold changes are depicted in the following infographics

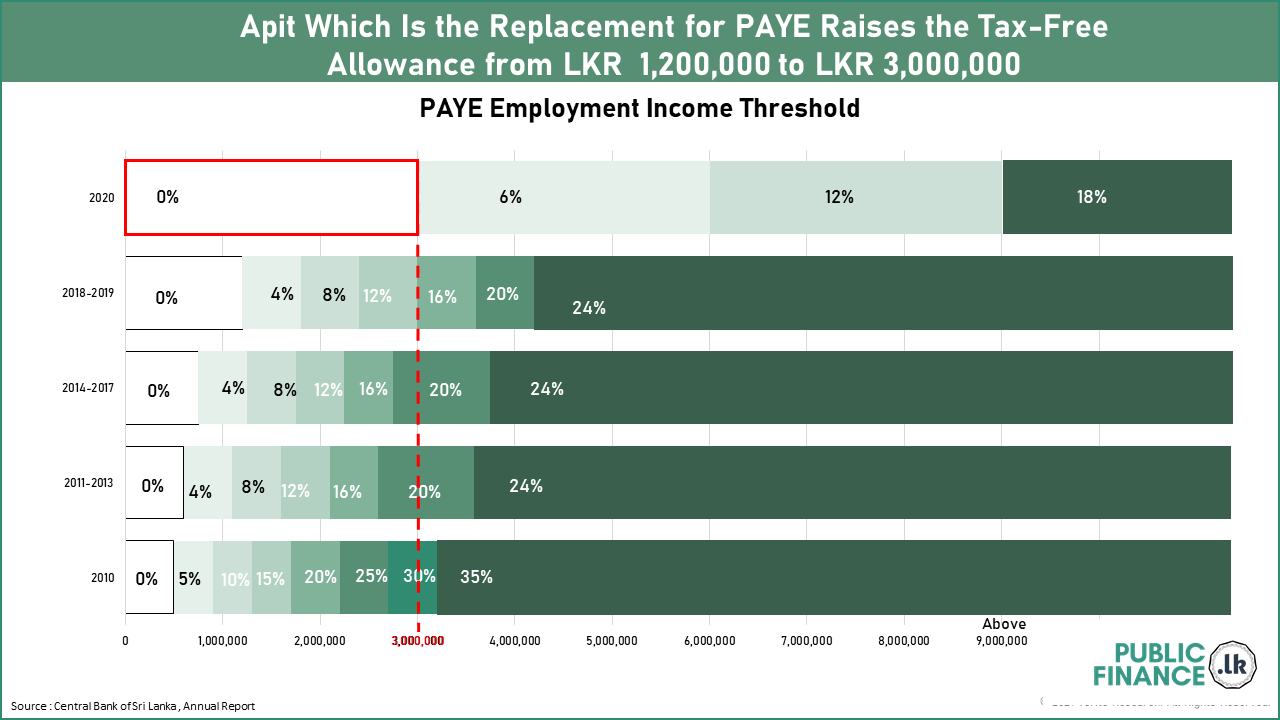

The changes in 2020 also saw the removal of the Pay As You Earn (PAYE) tax under which the employment income of individuals was administered as a witholding tax. Under the PAYE tax regime the employers were required to deduct the relevant tax from the employees' salary and remit the tax to the Inland Revenue Department (IRD).

PAYE was subsequently replaced by the Advanced Personal Income tax (APIT) which has a tax free threshold that is 2.5 times higher than the PAYE tax free threshold. Unlike PAYE which was a mandatory payment, the APIT is a voluntary tax based on the preference of the employee.