The Presidential Commission of Inquiry that investigated the 2015 Bond Scam recommended a forensic audit of the EPF's historical transactions in the bond and equity markets. The forensic audit, published in 2019, produced five reports. Two were focused entirely on the EPF’s transactions: one on bond market transactions, titled “Investigation on primary and secondary market transactions of Employees Provident Fund involving treasury bonds issued /transacted during the period from 1 January 2002 to 28 February 2015”, and the other on equity market transactions, titled “Project Diamond Final report: The Monetary Board of Central Bank of Sri Lanka (November 2019)”.

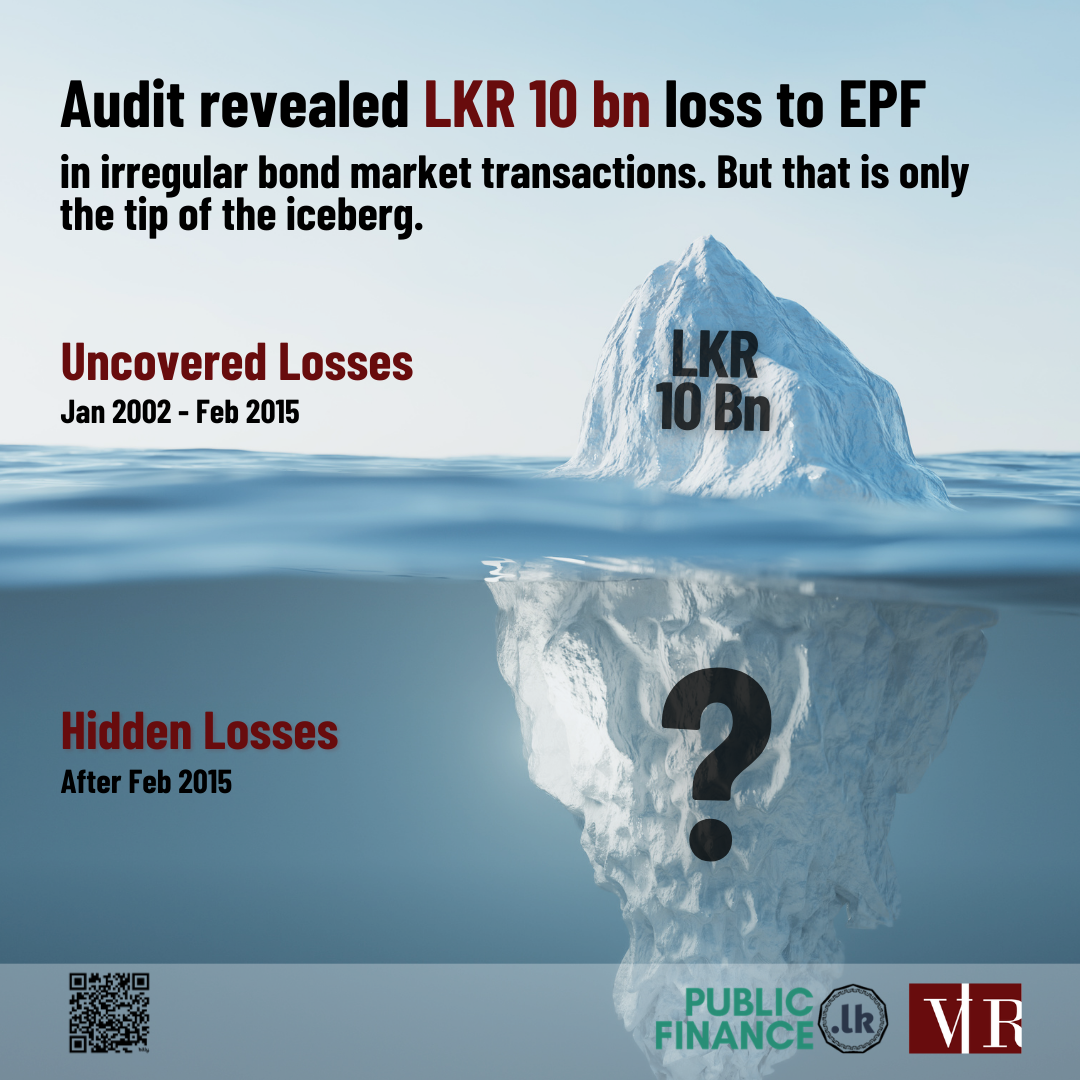

The bond market report revealed that EPF incurred losses amounting to nearly LKR 10 billion (LKR 9,826 million) due to irregular bond market transactions between January 2002 and February 2015. However, the forensic audit only examined losses up to February 2015, excluding the subsequent period. The Presidential Commission identified February 2015 to March 2016 as a period during which a third party made significant gains from dealings with the EPF, with profits estimated at around LKR 6,400 million. By focusing only on the pre-2015 period, the audit potentially underrepresents the total losses, suggesting that the nearly LKR 10 billion in reported losses could be just the tip of the iceberg.

The EPF, Sri Lanka's largest social security scheme, is designed to ensure the financial stability of employees in private sector companies, state-sponsored corporations, statutory boards, and private businesses during retirement. It is funded by mandatory contributions from both employers and employees. Therefore, any losses to the EPF directly affect the retirement savings of its members, jeopardizing their financial security in retirement.

Verité Research has extensively highlighted the mismanagement of the EPF and its impact on contributing members. You can access them here.

Stay tuned for an upcoming in-depth report on these losses, along with details on comparable stock market losses.