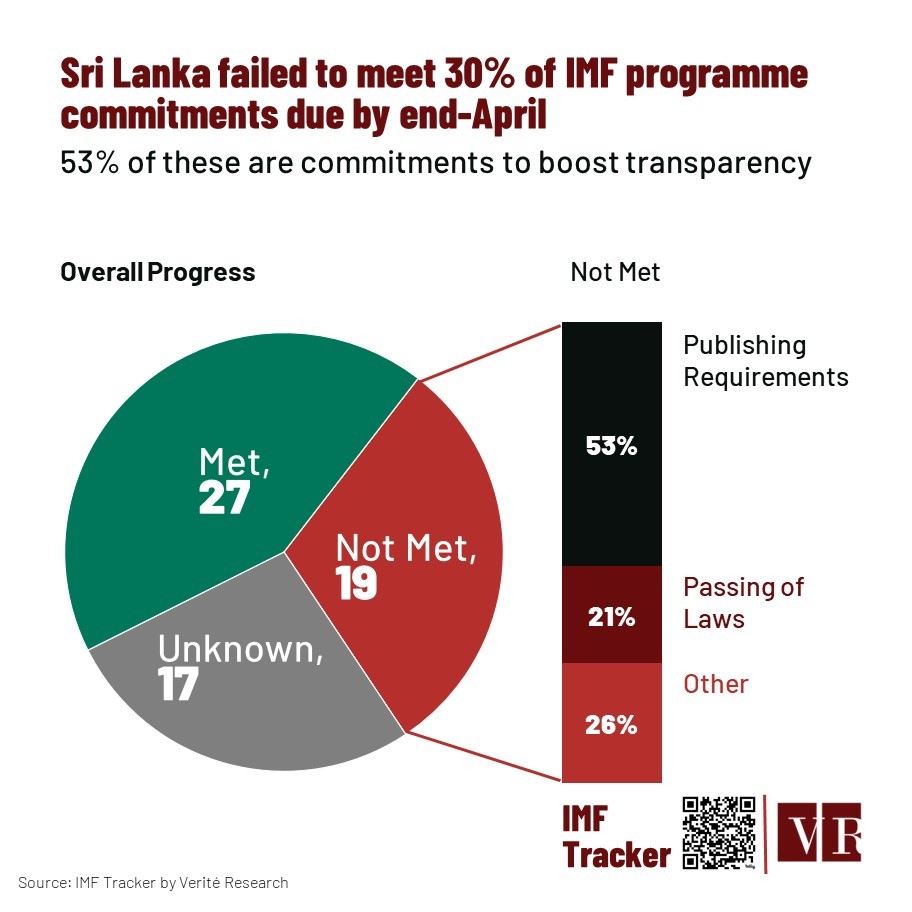

By the end of April 2024, Sri Lanka has not met 30% of its due commitments, which translates to a total of 19 unfulfilled obligations. The majority of these unmet commitments pertain to enhancing transparency and enacting legislation. The summary of commitments that are not yet due is shown in the table below:

|

Transparency/Publishing Requirements |

Enacting of legislation |

Other |

|

Publish semi-annually public procurement contracts and estimation of tax exemptions |

Introduce automatic indexation of excises to inflation |

Obtain Cabinet approval of a strategy to build a VAT refund system and achieve a full repeal of SVAT, with timeline and intermediate steps |

|

Publish direct costs of tax incentives granted via the SDP and BOI act |

Submission of the Public Finance management law to parliament |

Obtain Cabinet approval of a reduction in the limit on government guarantees to 7.5 percent of GDP |

|

Publication of a government action plan for implementing recommendations in the Governance Diagnostic report |

Enact legislation on assets recovery in compliance with the UNCAC |

Complete implementation of ITMIS |

|

Ensure that the annual reports for 2022 of all 52 major SOEs are published |

Make legislative change to set up a debt management agency |

Social spending to 0.6 percent of GDP (LKR 187 Bn) by Dec 2023 |

|

Publish audited financial statements of all but five SOEs |

|

Ensure that starting from January 2024, cash transfers under Samurdhi will cease |

|

Publish quarterly debt bulletins |

|

|

|

Publishing implementation plans for the Anti-Corruption Act |

|

|

|

Introduction, tracking and reporting quarterly KPIs of tax compliance |

|

|

|

Reporting of monthly cash flows by the Department of State Accounts |

|

|

|

Implementation of the amendments to the Banking Act |

|

|