A recent proposal initiated by the G7 to introduce a global minimum corporate tax rate of 15% has been strongly backed by 130 countries. However, Sri Lanka was one of the nine countries that did not agree to this proposal.

The major motivation for introducing this proposal is to limit Multinational Companies from recognizing profits in countries with low tax rates and thus avoiding taxes. To combat this and to ensure that companies pay their fair share of taxes irrespective of where they are located, introducing a minimum global corporate tax rate is seen as a measure towards achieving this goal.

Sri Lanka currently charges a standard corporate tax rate of 24% on companies. However, it provides companies in selected sectors concessionary corporate income tax rates; Manufacturing is taxed at 18% while SME’s, Export Goods, Tourism, Construction, Agro Processing, Healthcare and Educational Services are taxed at 14%. Agriculture, Fisheries, Livestock, IT and Enabled Services are fully exempted from paying corporate income taxes. Sri Lanka charges a higher income tax rate of 40% on companies engaged in sectors such as Liquor, Tobacco, Betting and Gaming.

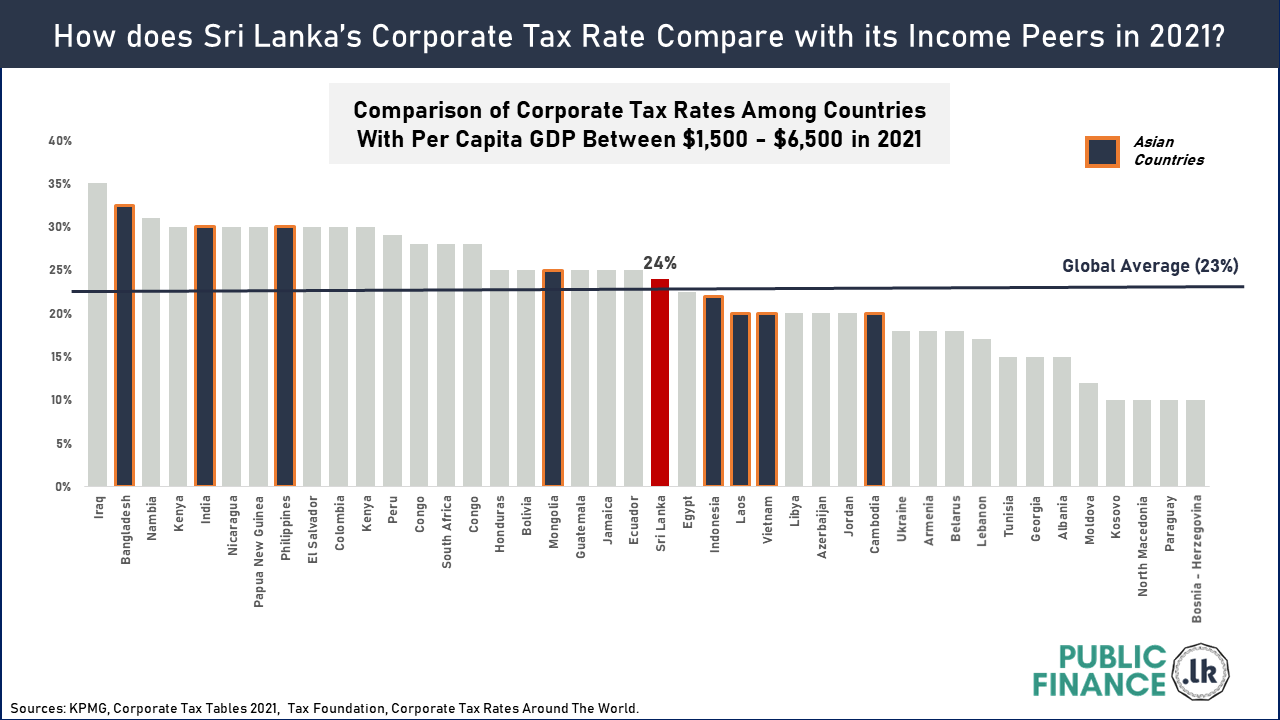

Sri Lanka’s standard corporate tax rates are on par with the global average tax rate, standing at 23% in 2021. Many of Sri Lanka’s income peers charge a much higher corporate income tax rate. This is especially seen among our Asian counterparts such as India, Bangladesh and Philippines that charge taxes above 30%.

This is a global comparison of tax rates charged by different countries. .

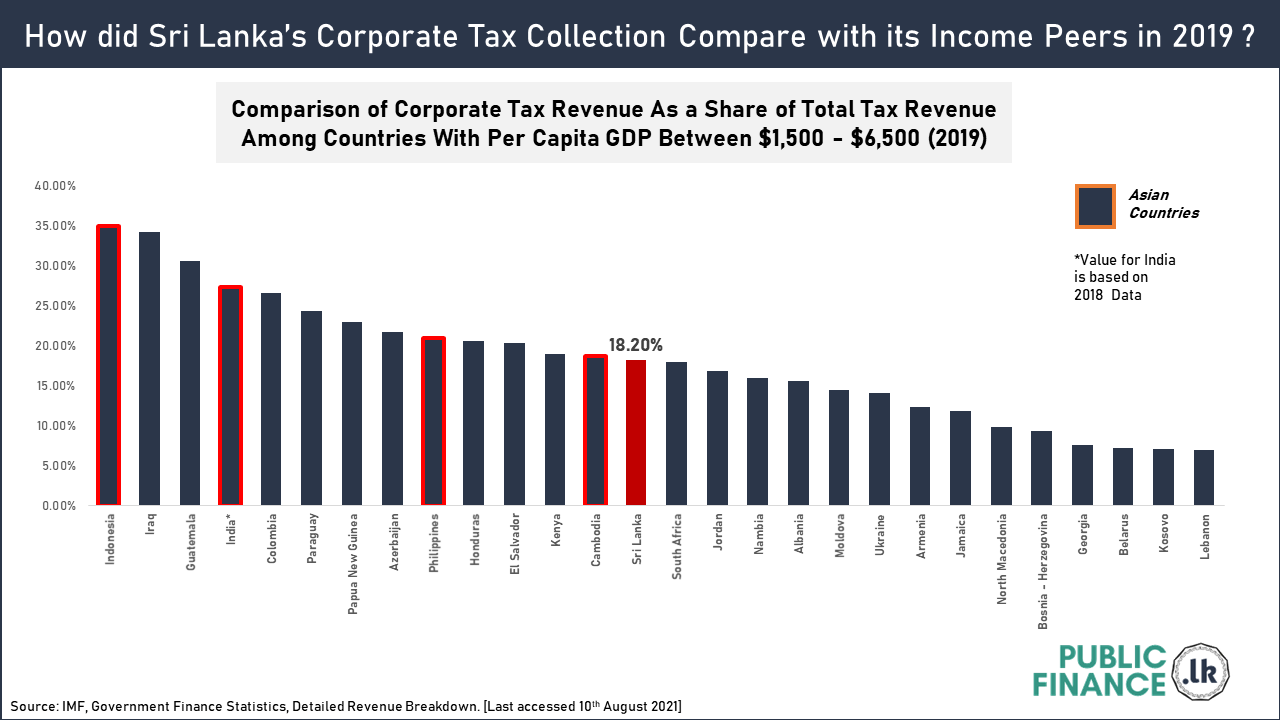

The revenue collected by Sri Lanka from corporate taxes amounts to 15% of the total tax revenue in 2020. Compared to Sri Lanka’s income peers, the percentage of corporate tax Sri Lanka collects is far lower.

Sources